As the European Federation of Investors and Financial Services Users, BETTER FINANCE is supported by a small, dedicated team of policy experts, finance professionals, and communications specialists based in Brussels. Together, we carry out the core activities of the Federation, working closely with our national member organisations across Europe and beyond.

We engage with policy-makers, individual investors, and the wider community of stakeholders. We are also active on LinkedIn, Facebook and Instagram. New members and supporters can explore how to get involved.

Our history: BETTER FINANCE was created in 2009, in the aftermath of the 2008 financial crisis, to give consumers of financial services a voice — particularly in their role as savers and investors.

BETTER FINANCE’s predecessor, “Euroshareholders”, was created in 1992 and gathered about 30 individual shareholder organizations in Europe. Euroshareholders joined BETTER FINANCE in 2012. This marked a major milestone towards a fully unified representation of european citizens’ interests as financial services users.

BETTER FINANCE’s predecessor, “Euroshareholders”, was created in 1992 and gathered about 30 individual shareholder organizations in Europe. Euroshareholders joined BETTER FINANCE in 2012. This marked a major milestone towards a fully unified representation of european citizens’ interests as financial services users.

BETTER FINANCE is one of the few organisations that advocate for the interests of the many — not the few — in the field of financial services at EU level.

Contact BETTER FINANCE

-

Press, event and membership enquiries:

communications@betterfinance.eu -

Policy and regulatory matters:

policy@betterfinance.eu -

General enquiries:

info@betterfinance.eu— For more information, check the below lists

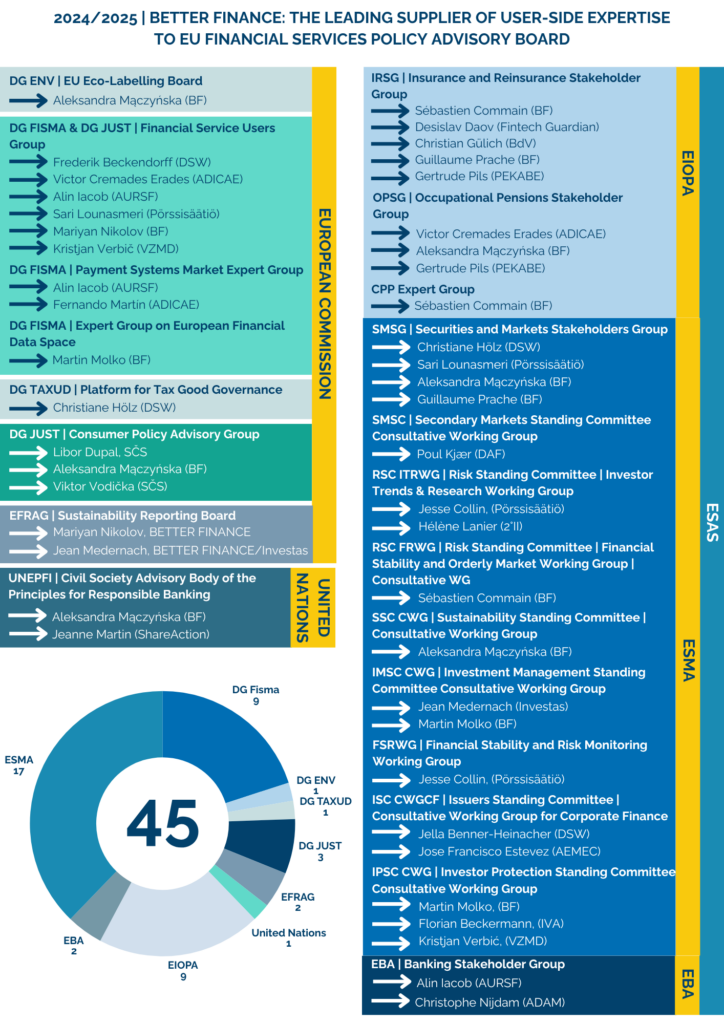

BETTER FINANCE Participation in EU Financial Advisory Groups

BETTER FINANCE, alongside its member organisations, actively participates in various EU financial stakeholder groups. Through this participation, BETTER FINANCE aims to ensure that European decision-making institutions protect the interests of individual investors and financial service users, rather than serve the financial industry.

By being actively involved in EU advisory groups, we aim to ensure that user perspectives are considered in key decision-making processes across multiple European institutions. Through this involvement, BETTER FINANCE and its member organisations advocate for improved financial services, consumer protection, and sustainable finance initiatives.

Below, you can find the complete list of stakeholder groups and the representatives from BETTER FINANCE and its member organisations.

European Commission

DG FISMA and DG Just | Financial Services User Group

Frederik Beckendorff, DSW – Deutsche Schutzvereinigung für Wertpapierbesitz

Victor Cremades Erades, Adicae – Asociación de Usuarios de Bancos, Cajas y Seguros

Alin Jacob, AURSF – Asociația Utilizatorilor Români de Servicii Financiare

Sari Lounasmeri, Pörssisäätiö Börsstiftelsen – Finnish Foundation for Share Promotion

Mariyan Nikolov, BETTER FINANCE

Kristjan Verbić, VZMD – Vseslovensko Združenje Malih Deležnikov – PanSlovenian Stakeholders’ Association

DG FISMA | Payment Systems Market Expert Group

Alin Jacob, AURSF – Asociația Utilizatorilor Români de Servicii Financiare

Fernando Martin, Adicae – Asociación de Usuarios de Bancos, Cajas y Seguros

DG FISMA | Expert Group on European Financial Data Space

Martin, Molko, BETTER FINANCE

DG TAXUD | Platform for Tax Good Governance

Christiane Hölz, DSW – Deutsche Schutzvereinigung für Wertpapierbesitz

DG Just | Consumer Policy Advisory Group

Libor Dupal, SČS – Czech Consumer Association

Aleksandra Mączyńska, BETTER FINANCE

Viktor Vodička, SČS – Czech Consumer Association

DG ENV | EU Eco-Labelling Board

Aleksandra Mączyńska, BETTER FINANCE

EFRAG Sustainability Reporting Board

Mariyan Nikolov, BETTER FINANCE

Jean Medernach, BETTER FINANCE/Investas

European Banking Authority

Banking Stakeholder Group

Alin Jacob, AURSF – Asociația Utilizatorilor Români de Servicii Financiare

Christophe Nijdam, A.D.A.M. – Association pour la défense des Actionnaires Minoritaires

European Securities and Markets Authority (ESMA)

Securities and Markets Stakeholder Group (SMSG)

Christiane Hölz, DSW – Deutsche Schutzvereinigung für Wertpapierbesitz

Sari Lounasmeri, Pörssisäätiö Börsstiftelsen – Finnish Foundation for Share Promotion

Aleksandra Mączyńska, BETTER FINANCE

Guillaume Prache, FAIDER – Fédération des Associations Indépendantes de Défense des Épargnants pour la Retraite

Secondary Markets Standing Committee Consultative Working Group (SMSC CWG)

Poul Kjær, DAF – Dansk Aktionærforening

Risk Standing Committee | Investor Trends and Research Working Group (RSC ITRWG)

Jesse Collin, Pörssisäätiö Börsstiftelsen – Finnish Foundation for Share Promotion

Hélène Lanier, 2 Degrees Investing Initiative

Sustainability Standing Committee | Consultative Working Group (SSC CWG)

Aleksandra Mączyńska, BETTER FINANCE

Risk Standing Committee | Financial Stability and Orderly Market Working Group Consultative Working Group (RSC FRWG CWG)

Sébastien Commain, BETTER FINANCE

Investment Management Standing Committee Consultative Working Group (IMSC CWG)

Jean Medernach, Investas – Association Luxembourgeoise des Investisseurs Privés

Martin Molko, BETTER FINANCE

Financial Stability and Risk Monitoring Working Group (FSRWG)

Jesse Collin, Pörssisäätiö Börsstiftelsen – Finnish Foundation for Share Promotion

Issuers Standing Committee | Consultative Working Group for Corporate Finance (ISC CWGCF)

Jella Benner-Heinacher, DSW – Deutsche Schutzvereinigung für Wertpapierbesitz

Jose Francisco Estevez, AEMEC – Asociación Española de Accionistas Minoritarios de Empresas Cotizadas

Investor Protection Standing Committee Consultative Working Group (IPSC CWG)

Martin Molko, BETTER FINANCE

Florian Beckermann, IVA – Interessenverband für Anleger

Kristjan Verbić, VZMD – Vseslovensko Združenje Malih Deležnikov – PanSlovenian Stakeholders’ Association

Sustainability Standing Committee | Consultative Working Group (SSC CWG)

Aleksandra Mączyńska, BETTER FINANCE

European Insurance and Occupational Pensions Authority (EIOPA)

Occupational Pensions Stakeholder Group (OPSG)

Victor Cremades Erades, Association of Consumers and User of banks, saving banks, financial products and insurance (ADICAE)

Aleksandra Mączyńska, BETTER FINANCE

Gertrude Anna Pils, Pekabe – Schutzverband der Pensionskassenberechtigten

Insurance and Reinsurance Stakeholder Group (IRSG)

Sébastien Commain, BETTER FINANCE

Desislav Danov, Fintech Guardian

Christian Gülich, BdV – Bund der Versicherten

Guillaume Prache, FAIDER – Fédération des Associations Indépendantes de Défense des Épargnants pour la Retraite

Gertrude Anna Pils, Pekabe – Schutzverband der Pensionskassenberechtigten

CPP Expert Group

Sébastien Commain, BETTER FINANCE

United Nations

Civil Society Advisory Body of the Principles for Responsible Banking

Aleksandra Mączyńska, BETTER FINANCE

Jeanne Martin, ShareAction

Legal Committee

The Legal Committee (LC) assists the BETTER FINANCE Team and Board in all legal matters related to current policy issues and activities the organisation carries out. The LC is headed by a Chair and Vice-Chairperson and comprises various BETTER FINANCE members. The LC meets twice per year.

- Chair: Christiane Hölz, Managing Director, Deutsche Schutzvereinigung für Wertpapierbesitz e.V. (DSW)

- Vice-chair: José F. Estévez, Managing Partner of CREMADES & CALVO-SOTELO ABOGADOS

Action Committee

The Action Committee (AC) is a committee of the BETTER FINANCE Board of Directors. The Committee is composed of the BETTER FINANCE President (who is chair of the committee) and Vice-Presidents. The Managing Director and Executive Director report to the Action Committee at least quarterly on the progress of the work programme and any other issues arising.

The Action Committee also takes responsibility for reviewing the draft financial statements and the external audit report of the previous fiscal year and the risks involved in the draft budget of the current year prior to the review by the Board. The Action Committee approves all expenses and projects over 5000 EUR.

Strategic Committee

The Strategic Committee (SC) is a committee composed of members of the BETTER FINANCE Board of Directors as well as members of the BETTER FINANCE Executive Team, which informs the BETTER FINANCE Board regarding long-term strategy and key strategic decisions.

The BETTER FINANCE Team

As the European Federation of Investors and Financial Services Users, BETTER FINANCE is supported by a small dedicated Brussels-based team of policy experts, finance professionals, and communications specialists. Together, we carry out the core activities of our Federation of retail investor associations, working closely with our national member organisations across Europe and beyond.

We also engage with the wider community of policy-makers and individual investors on LinkedIn, Facebook and Instagram.

New members and supporters can explore how to get involved.

Contact Us

-

Press, event and membership enquiries:

communications@betterfinance.eu -

Policy and regulatory matters:

policy@betterfinance.eu -

General enquiries:

info@betterfinance.eu

Managing Director,

Aleksandra Mączyńska (email)

Aleksandra Mączyńska is coming from Warsaw, Poland, where she was the Deputy Director of the International Relations and Communication Department of the Polish consumer and competition watchdog.

She studied at the Faculty of Management at the Poznan University of Economics and at the Warsaw School of Economics. She has also a vast experience in management of international projects, e.g. EU funded capacity building projects. As a Fellow of the Robert Bosch Foundation Programme for the Young Executives from the Public Sector, she worked at the Division for World Bank International Monetary Fund, Debt Issues and International Finance Structure at the German Federal Ministry for Economic Cooperation and Development. She was an expert at various EU Council’s Working Parties such as the WP on Financial Services and WP on Competitiveness and Growth, as well as European Commission’s Working Groups and Advisory Committees. One of her task was also external representation and managing professional networks such as Consumer Policy Network (CPN), International Consumer Protection and Enforcement Network (ICPEN), European Competition Network (ECN) and OECD Competition Committee.

EU expert groups: Member of the Directorate-General for the Environment on the European Commission Eco-labelling Board, Member of the European Insurance and Occupational Pensions Authority (EIOPA) Occupational pensions Stakeholder Group (OPSG), Member of the United Nations Civil Society Advisory Body of the Principles for Responsible Banking (UNEPFI).

Executive Director,

Matis Joab (email)

Matis Joab joined BETTER FINANCE at the beginning of 2020 as Finance and Administration Officer, before being promoted to Executive Director in July 2023. Since joining, he has been in charge of finances, administration and member relations, as well as representing BETTER FINANCE at the European Financial Reporting Expert Group and contributing to BETTER FINANCE’s research work in relation to pension savings and investor rights.

He has a Bachelor’s degree in Applied Economics and a Master’s degree in Management from Tallinn University of Technology. After working 6 years in the private sector in Estonia, mostly in the commercial real estate sector, he moved to Brussels to become the Financial Director of the European Students’ Forum (AEGEE).

In addition to his knowledge of finance and economics, Matis has a deep interest in geopolitics. He is bilingual in Estonian and English and has a decent grasp of both French and German.

Director of Communications

Arnaud Houdmont (email)

Arnaud Houdmont joined the team at BETTER FINANCE following a varied and multi-facetted career in the world of communication, press relations and research at the heart of Europe. During this time he worked closely with policy makers from the European Commission, the European Parliament and private sector stakeholders on topics such as youth employment, entrepreneurship, health policy, sustainability and innovation. Prior to this he earned a master’s degree in Global Communication from Goldsmith’s College (University of London) and a bachelor’s degree in International relations from Sussex University.

His studies and career have given him a critical and analytical insight in a range of issues, as well as a profound knowledge of the political economy, media and the European institutions. On a personal level Arnaud is fascinated by all aspects relating to sustainable development and political economy.

At BETTER FINANCE, Arnaud is responsible for all communications activities and the continued development of an inclusive communication strategy aimed at reaching all interested parties and stakeholders. He speaks fluent Dutch, English and French and has a very good working level of Spanish.

Research & Policy Officer,

Sébastien Commain (email)

Sébastien Commain is Research and Policy Officer at BETTER FINANCE. He specialises in Financial Services Regulation and Capital Markets Research.

Sébastien holds a Masters’ degree in European affairs from Sciences Po Paris and a Ph.D. in political science from the Université du Luxembourg. Before joining BETTER FINANCE, Sébastien worked as an interest representative, a role in which he initially developed a strong taste for financial regulation issues as well as advocacy and policy analysis skills. He then turned to academia, working at the College of Europe for several years, before undertaking a Ph.D. on the influence of financial interest groups in EU and international policy making and the reform of bank capital requirements.

Research & Policy Officer,

Martin Molko (email)

Martin Molko is a Research and Policy Officer at BETTER FINANCE, where he works on digital and self-directed investing, shareholder protection, and policy frameworks affecting retail financial markets. His expertise covers financial innovation in consumer-facing services – including FinTech, (neo)broker business models, robo-advisory, AI, and evolving retail distribution channels, products and services. He contributes to EU policy debates on MiFID II/MiFIR – including market structure – as well as SRD II and the Listing Act. He also engages on investor education, financial inclusion, and safeguards against misleading or fraudulent practices. His work further covers shareholder engagement, collective redress, and the removal of cross-border barriers to market access for retail investors.

Martin is a member of the European Commission’s Expert Group on the European Financial Data Space and ESMA’s Consultative Working Groups on Investment Management and Investor Protection (IMSC and IPSC).

Martin obtained a Bachelor’s Degree in Information and Communication from the University of Nice and pursued a specialised Master’s Degree in European Studies at the Free University of Brussels (ULB). He also attended summer programmes on European multilateralism and economic development. In previous roles, he consolidated his communication and reporting skills, including at a European news agency where he developed a strong interest in finance. He has lived in Belgium, France, and Germany, gaining experience in consulting as well as in project management and editorial work within the academic sector.

Project & Office Manager,

Susie Naval (email)

Susie is a Project & Office Manager at BETTER FINANCE, where she develops new projects and partnerships and backs up the internal management.

Susie holds a bachelor’s degree in economic law and a master’s degree in environmental and territorial governance from Panthéon-Sorbonne University.

She worked previously in the public and non-profit world, in Brussels and Paris, for several projects in the field of sustainable economy: circular economy, local currencies, social economy, etc. She is experienced both in legal research projects and in business management.

On a personal level, she is a proud member of several cooperative and is always enthusiast for initiatives promoting sustainable and fair consumption. She is interested in politics, pop culture, and often has a creative project on the run.

Research & Policy Officer,

Mariyan Nikolov (email)

Mariyan Nikolov is a Research & Policy Officer at BETTER FINANCE, where he specialises in the areas of Sustainable Finance, Reporting and Corporate Governance. He is also involved with the coordination of relevant policy developments with member organizations and leads on fundraising, consultation responses, reports and working groups on transition investing, engagement and broader sustainability dossiers. Mariyan is also a Member of the Financial Services User Group at the European Commission.

In his previous roles – with government representation, EU institutions and the private sector – he led on multiple research projects encompassing sustainable finance initiatives and comparative regulatory developments, carbon pricing and trading, as well as broader financial services with international financial institutions.

Mariyan has an integrated MSci in International Relations and Global Issues from the University of Nottingham, UK whereby he also completed various study and volunteering projects across China, India and Malaysia in the fields of sustainability and fundraising. He is a native Bulgarian, Turkish, and English speaker and has some understanding of other languages including Russian and French.

Research & Finance Assistant,

Konrad Barth supports BETTER FINANCE’s research and policy team, with a particular focus on digital finance and pension adequacy. He holds a Master’s in Economics, specialising in Monetary Policy and Banking from the University of Amsterdam and a Bachelor’s in Economics from the University of Vienna.

Before joining BETTER FINANCE, Konrad gained experience across the financial sector, including at SCOPE Group – Europe’s largest credit rating agency – and at a boutique German M&A advisory firm. He is driven by the conviction that finance, when aligned with the public interest, can be a powerful tool to build a more resilient and inclusive European Union.

Outside of work, he is a lifelong pianist and finds balance through sports and reading. He is a native German and Luxembourgish speaker and is fluent in French and English.

Communications Officer

Rina Zhubi (email)

Rina Zhubi is a Communications Officer at BETTER FINANCE, where she pushes forward the organisation’s online communication. As part of the communication team, Rina has a multifaced role, preparing communication materials, sending email campaigns, and managing online channels including the website and social media.

Rina first moved to Brussels to finish her master’s in Media and Journalism in Europe from Vrije Universiteit Brussel from which she graduated Magna Cum Laude. Prior to that, she worked in various communication and marketing roles, during which she launched numerous campaigns, wrote video scripts and articles, prepared visuals, and managed social media. She holds a bachelor’s degree in Management and Economics from the Rochester Institute of Technology.

On a personal level, Rina likes to take on creative projects such as writing poetry or making collages. She holds dual nationality from Kosovo and Croatia.

Legal & Policy Assistant

Anna Rita Fernandes (email)

Ana Rita Fernandes is a Legal & Policy Assistant at BETTER FINANCE, assisting the policy and research team with the monitoring of relevant EU legislative files. Ana Rita holds a Bachelor of Law from the University of Minho in Portugal and an LL.M. in International Business Law from the Université Libre de Bruxelles.

While pursuing her studies, she gained valuable experience working part-time for the Belgian Presidency of the Council of the European Union as a Liaison Officer, where she honed her expertise in EU interinstitutional relations.

In addition to her native Portuguese, Ana Rita is fluent in English and French and possesses a strong command of Spanish. With a strong legal background, Ana Rita has a particular interest for EU Competition Law and the financial implications of EU regulations within the internal market.

Guillaume Prache is the Founder of BETTER FINANCE, the European Federation of Investors and Financial Services Users. Throughout his career, Guillaume has represented the interests of financial services users in various advisory boards across EU institutions. Currently, he sits at the ESMA’s Securities and Markets Stakeholder Group and EIOPA’s Insurance and Reinsurance Stakeholder Group and at the French financial regulator AMF. He has served as the first chair of the ESMA Stakeholder Group and as a former vice chair of the European Commission’s FSUG (Financial Services User Group), as well as a member of the EIOPA Pensions and EBA Banking Stakeholder Groups.

Guillaume started as a magistrate at the French Court of Auditors and has extended and international experience in financial matters, most recently as Chief Financial Officer of Rhône-Poulenc Rorer, Inc., a “Fortune 500” publicly-listed pharmaceutical company (today Sanofi) from 1997 to 2000, and then as Managing Director of the European affiliate of the Vanguard Group, Inc., a global leader in asset management, from 2000 to 2006. He has taught asset management for the CIWM (Certified International Wealth Manager) program and written two books, Politique Économique Contemporaine (1989) and Les Scandales de l’Épargne Retraite (2008), as well as various articles on economics and finance.

Jella Benner-Heinacher is the President of BETTERFINANCE and a Senior Advisor for Foreign Affairs at DSW, the leading Shareholder association in Germany. As part of her role for DSW, she spearheads international initiatives through her involvement with BETTERFINANCE. Her responsibilities include Addressing Corporate Governance and Shareholder issues including SRD2, Delisting and Collective Redress.

Jella is representing the interests of minority shareholders at the Level of the EU and also as member of a Consultative Group at ESMA in Paris. She is an attorney with an educational background spanning France, Switzerland, and the United States.

Florian Beckermann is the Executive Director of the Austrian Shareholder Association (IVA), an organisation to which he has been an active member since 2009. He is also a Board Member at BETTER FINANCE, ESMA’s Investor Protection Standing Committee (IPSC), the World Federation of Investors Council (WFIC) and Supervisory Board Member oekostrom AG.

As a distinguished economist and legal expert, Florian has extensive experience in investor advocacy and corporate governance. He is part of the standing working council of the Republic of Austria on Corporate Governance. His professional journey includes serving as Managing Director of various companies, Supervisory Board Member and Associate Professor at the IMC University of Applied Sciences Krems.

With a dedication to sustainable finance, Florian has extensive knowledge and experience in ESG analysis, as well as being a Certified Environmental, Social, and Governance Analyst (CESGA). Florian holds a degree in law from the University of Bonn, a degree in economics from Fernuniversität Hagen and a postgraduate Master in International tax law from Wirtschaftsuniversität Wien.

Board Members

SII – Stowarzyszenie Inwestorów Indywidualnych, Poland

Jarosław Dominiak

AEMEC – Asociación Española de Accionistas Minoritarios de Empresas Cotizadas, Spain

José F. Estévez

Place des Investisseurs, France

Anne Gaignard

UKSA – UK Shareholder Association, United Kingdom

Helen Gibbons

ADICAE – Asociacion de Usuarios de Bancos Cajas y Seguros, Spain

José Carlos Gómez Fernández

VFB – Vlaamse Federatie van Beleggers, Belgium

Ben Granjé

AURSF – Asociata Utilizatorilor Romani de Servicii Financiare, Romania

Alin Iacob

Aktiespararna, Sweden

Sverre Linton

Read More

Read More

Read More

Read More

Read More

Read More

Read More

Read More

*Associate Member (without voting rights)

How to become a Member

The BETTER FINANCE Scientific Council consists of highly skilled and experienced independent academics who help us deliver high quality research for financial services users, other stakeholders and policy-makers.

The Scientific Council consists of the following members (alphabetic order):

- Prof. Barbara Alemanni (Italy)

- Prof. Dr. Jan Sebo (Slovakia)

- Prof. Dr. Rüdiger Veil (Germany)

- Mr. Nicolas Véron (USA/EU)

Chair: Prof. Pierre-Henri Conac (Luxembourg)

The Scientific Council responds to the need for more independent research in financial services to provide a sound and unbiased basis for financial policy recommendations. This is reflected in BETTER FINANCE’s Scientific Council, as many of its members also have extended experience in EU advisory bodies on financial services policy.

BETTER FINANCE Scientific Council members (as of January 2024)

| Jan Sebo is associate professor and researcher at the Matej Bel University (Faculty of Economics) in Slovakia, with a specialisation in Pension Finance, Pension Economics, Investing and Savings, Public Finance and Regulatory Policy. He leads the research team at the Orange Envelope platform, which provides automated independent personal finance advise and pension tracking services across all pension schemes in Slovakia. He is a former member of the Occupational Pension Stakeholders Group (OPSG) at EIOPA and a present member of the Financial Services User Group (FSUG) at the European Commission.

|

| Pierre-Henri Conac is a Professor of Financial Market Law at the University of Luxembourg where he founded the Master in European Banking and International Financial Law (LL.M.). He is also Max Planck Fellow at the Max Planck Institute Luxembourg and recently been appointed Acting Head of the Institute’s two research departments. He authored securities market regulations for the French Commission (COB) and the US SEC. Conac played a key role in shaping EU and national policies on company law, banking, and financial law. Like Rüdiger Veil, he is a former member in the category of Independent top-ranking academic of the Securities and Markets Stakeholders Group (SMSG), which advises the European Securities and Markets Authority (ESMA).

|

| Nicolas Véron is a senior fellow at Bruegel in Brussels and at the Peterson Institute for International Economics in Washington, DC. His research is mostly focused on financial systems and financial reform around the world, including global financial regulatory initiatives and current developments in the European Union. Nicolas Véron has authored and co-authored numerous policy papers on matters that include banking supervision and crisis management, financial reporting, the Eurozone policy framework, and economic nationalism. He participated as an expert in committees of the European Parliament, national parliaments in EU member states, and US Congress. In addition, Nicolas Véron is an independent non-executive board member at the Trade Repository arm of DTCC.

|

| Rüdiger Veil holds the Chair for Civil Law and Business Law at Ludwig-Maximilians-Universität, Munich. His main research areas are European corporate law and capital markets law. Rüdiger Veil has published numerous books, inter alia on “European Capital Markets Law”, and articles in top-ranked journals, particularly from a comparative perspective. Since 2012, he has been a member of an academic working group advising the German Federal Ministry of Finance with regard to EU financial market reforms. In addition, Rüdiger Veil has been a member of the ESMA Securities and Markets Stakeholders Group (SMSG); from 2016-2018, he was Chair of the Group. Rüdiger Veil has acted as an expert for the German, European, Chinese and Russian parliament.

|

| Barbara Alemanni is a Professor of Financial Markets and Institutions in the Department of Economics at the University of Genoa. Additionally, she serves as an Affiliate Professor of Banking and Insurance at SDA Bocconi School of Management in Milan. She imparts her knowledge in both Bachelor and Master courses covering Investments, Financial Markets, and Behavioural Finance. Barbara holds an MSc in Finance from City University in London and a BA in Economics from Bocconi University in Milan. Her primary research interests include the micro and macro structure of financial markets, investor protection, behavioural economics, and financial innovation. She has disseminated her research through publications in both domestic and international scholarly journals and academic books. |