The overall objective of the Pan-European Personal Pensions (PEPP) product is to offer pension savers a viable alternative that embeds appropriate risk-reward calibrations, that transparent and cost efficient and that provides decent real long-term returns for old age. In short, the PEPP should represent “a quality label for EU personal pension products and increase trust among consumers”.

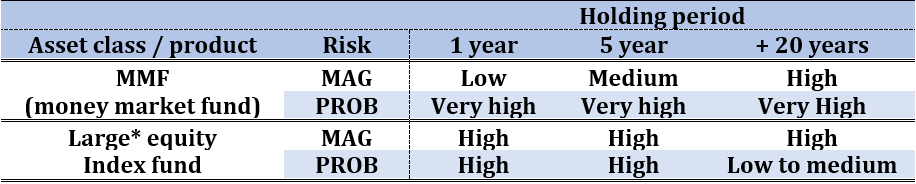

The summary risk indicator must show two tables that present the risks of the assets and the risk of the product as it advances in its investment horizon.

The first table (financial risk) should show the probability of loss and the magnitude of loss.

The first table (financial risk) should show the probability of loss and the magnitude of loss.

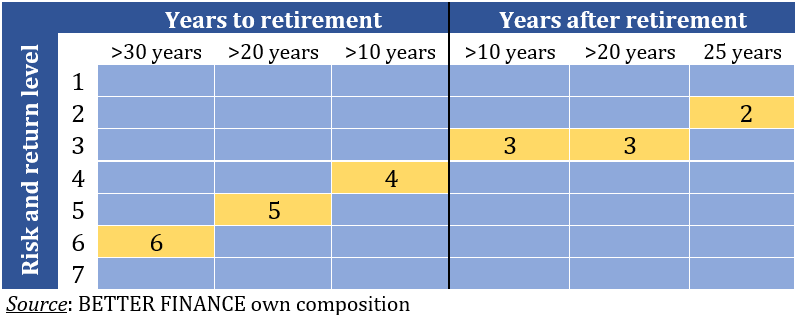

The risk and reward indicator should be bi-dimensional, displaying the aggregate risk profile of the product and the remaining investment horizon, continuing in the deccumulation phase.

The risk section should contain the following warning, depending on the type of product:

Warning! This product does not have a guarantee, nor inflation protection. A low level of risk does not mean no risk at all. Investments are subject to market fluctuations and financial loss and you may lose all your money. The tax law applicable in your Member State may have an impact on your actual pay-out.

For long-term savings products, there should be an objective (for example: achieving a certain level of savings) defining the risk of the product.

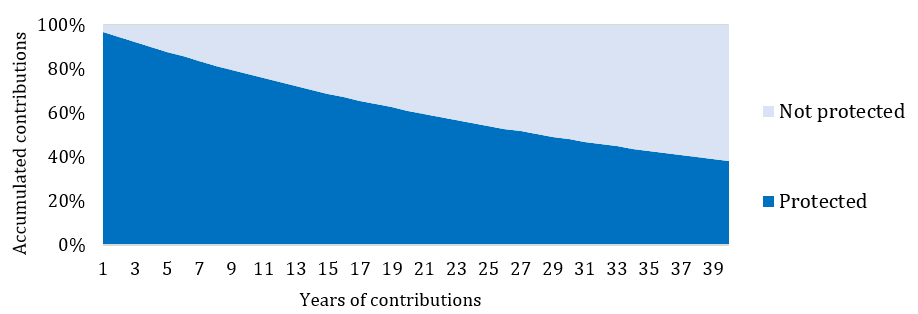

The capital guarantee must show graphically how much of the accumulated capital of the PEPP saver will be protected at all stages of the accumulation phase. For reasons of simplicity, the time unit should be annual and should start with the longest period available and finish at the targeted end date of the decumulation phase. The description should be as follows:

“This product guarantees that you will recoup your [net/nominal/real] accumulated capital upon retirement, representing the sum of all your contributions paid in this product [minus or not] the fees and charges taken each year, [with or without taking into account inflation].”

The purpose of the basic PEPP is to be a low-cost default investment option that would be assigned to the PEPP saver in absence of an active choice. Considering the high costs of investment products in the EU and the detrimental effects these have been proved to have on the returns of investment products, a cost limit of 1% for the passive basic PEPP is of absolute importance.

The basic PEPP cost cap must represent the total expense ratio that will be incurred by the PEPP saver from his accumulated capital. Excluding cost categories from the basic PEPP cost cap will render inefficient and even redundant the upper limit of this particular limit.

The cost cap for the basic PEPP cannot differentiate between products or risk-mitigation techniques used for the basic PEPP. The upper limit must be an all-inclusive figure of categories of costs, fees, and charges, including the cost of the guarantee for a capital guaranteed product.

It is the right of the PEPP saver to choose what type of decumulation (drawdown) method he prefers: either periodic installments (monthly, quarterly, annually) or lump-sum benefits. This attribute cannot be limited by imposing drawdown options on different investment alternatives, niether by imposing a limit on the outstanding amount (“you can withdraw to the limit of €X remaining in your balance“).

In instances where the saver chooses periodic installments from his accumulated savings, these must be fair and transparent. The calculation of the monthly amount to be disbursed must be made on realistic life expectancy approached (provided by Eurostat) and it must be clearly discloses how these are computed.

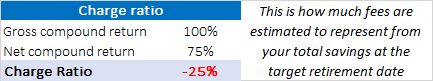

The summary cost indicator (SCI) must be fair, clear, and not misleading for the PEPP saver. It must show accurate figures, not estimations (as in the PRIIPs KID) on the difference between the gross and net return of the product at the target retirement date, in percentage terms. The SCI can be presented either as:

– the Charges Ratio (CR), preferably for lump sum drawdowns;

– the Wealth Reduction Rate (WRR), for periodic installments.

The Charges Ratio (CR) would show the difference between the gross and net returns at the end of the investment horizon, providing an accurate image of how much fees have eaten into profits, regardless of the recommended holding periods.

The CR should be expressed in percentage terms only since investors do not have an accurate scale of size for investment and compound returns, especially on long-term products. Moreover, difference will turn out incomparable if the PEPPs have different expected returns at the target retirement date.

The CR should be expressed in percentage terms only since investors do not have an accurate scale of size for investment and compound returns, especially on long-term products. Moreover, difference will turn out incomparable if the PEPPs have different expected returns at the target retirement date. Since many savers wish to use their pension products to obtain a monthly income during retirement, the Wealth Reduction Ratio (WRR) shows how much of the monthly income generated by the PEPP has been reduced by fees. The WRR will be calculated as the difference in the gross and net monthly payment during the assumed life expectancy period of the PEPP saver after retirement and expressed in monetary terms.

Since many savers wish to use their pension products to obtain a monthly income during retirement, the Wealth Reduction Ratio (WRR) shows how much of the monthly income generated by the PEPP has been reduced by fees. The WRR will be calculated as the difference in the gross and net monthly payment during the assumed life expectancy period of the PEPP saver after retirement and expressed in monetary terms.

PETITION: Stop the Capital Protection Scam & Get the PEPP Pension You Deserve

YOUR PENSION – The global pensions gap is widening and fees and inflation are destroying the value of long-term savings. Therefore, now more than ever, we – pensions savers – are in need of a simple, transparent and cost-effective long-term retirement savings product that would provide a decent return in the current low-interest environment.

Fortunately, the European Commission is working towards a simple, standardised and cost-effective Pan-European Personal Pension (PEPP), which could meaningfully reduce the pensions gap, by providing a good “value for money” option for all European savers and pensioners. The “Default Option” of such a PEPP should benefit from a real “capital protection” that makes sure that, upon retirement, you will at the very least get back the money that you invested in the first place. It is crucial to protect the full savings amount before the deduction of all accumulated fees, charges and expenses, and in real terms, i.e. offsetting the negative impact of inflation over time.

![]() Watch the video showing the scam here.

Watch the video showing the scam here.

THE SCAM – If the PEPP’s definition of capital adopted by the European Parliament and EU Council allows you to recoup only the nominal capital invested net of all accumulated fees and costs without offsetting inflation, it will destroy the purchasing power of your pension savings. Therefore, calling it “capital protection” is seriously misleading.

TIME FOR ACTION – Stand up against this scam, sign the BETTER FINANCE petition below and send this video and petition to your MEP.

- For more information, please watch our video.

- To find your MEP visit the European Parliament’s website.

Our documents

Pensions are one of our predilect subjects. Since 2014, we are the only entity in Europe publishing the real net returns of pension savings in 17 EU Member States, covering 88% of population and more than 40 retirement vehicles’ performances since 1999 onwards.

We worked hard to achieve a personal supplementary pension vehicle for EU citizens that is safe, cost efficient, simple, and that would actually contribute to reaching your pension adequacy level. Moreover, if you were to move around the EU with work, you can take your suitcase, passport, and your PEPP.

However, much work was done and still much more is needed to ensure that the PEPP will satisfy your necessities. You can see what we’ve done so far in the below documents – you may find them quite technical, but we had to get dirty in order to protect your interests.

1. PEPP Level 2 Position Paper

2. PEPP Consultation Paper response