BETTER FINANCE has been involved in the PRIIPs file since the begining, advocating for a simple, standardised, comparable and clear information document for all retail investment products across the EU (2009). BETTER FINANCE called on the European Parliament to put the interests of retail savers first through PRIIPs (2012), then recommended several improvements, such as disclosure of taxes and inducements (2013) and called to clarify and expand the scope to cover shares and bonds as well (2014).

BETTER FINANCE issued its first discussion paper on PRIIPs (2015) and participated in the initial ESMA consultation on Level 2 PRIIPs (2015-2016), following which we started to highlight the need for standardised past performance disclosure (2016). By the end of the year, EFAMA joined us in expressing concerns with regards to the implementation of PRIIPs, a position joined by the CFA Institute shortly after.

Our uphill struggle continued in 2017, including fighting political interests, but the voice of EU retail investors had less impact. BETTER FINANCE once more stressed the misleading and legally inconsistent nature of the PRIIPs KID regime in 2018 – most notably at the November 2018 public hearing – and continues to do so. As of 2019, we also started to provide input for the ESAs for the “quick fixes” at Level 2 through public consultations and participation to technical groups. We have participated at the European Supervisory Authorities’ (ESAs) Consumer Protection day, where we advocated on PRIIPs, and we were also part of the Technical Expert Group of the ESAs on the Review of PRIIPs Level 2.

Most recently, we have issued our Position Paper on PRIIPs and we find ourselves forced once more to campaign for the remediation of this PRIIPs KID regime that proves to be highly detrimental for investor protection.

Ten years later, BETTER FINANCE continues its unabated efforts to provide EU citizens with a clear, accurate and concise key information document that would allow them to:

– compare retail investment products across the EU;

– assess the quality and suitability of an investment product with their objectives; and

– make an informed financial investment decision.

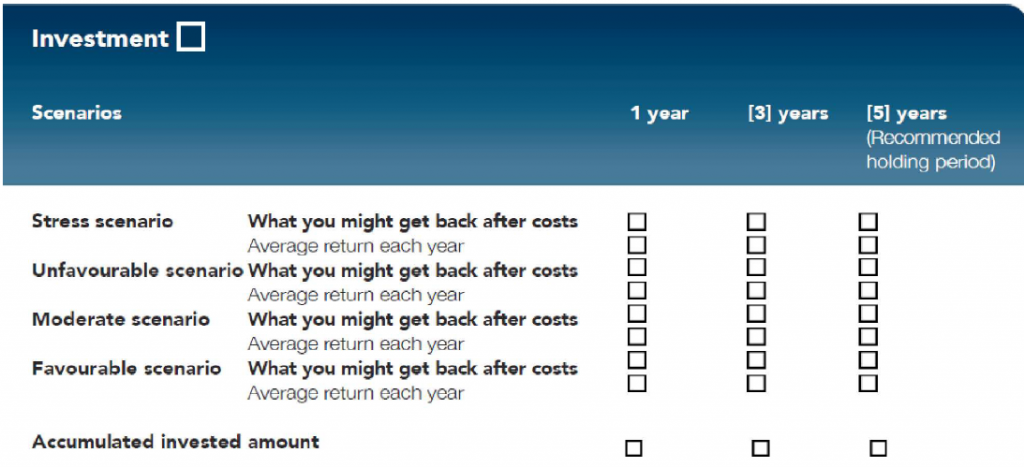

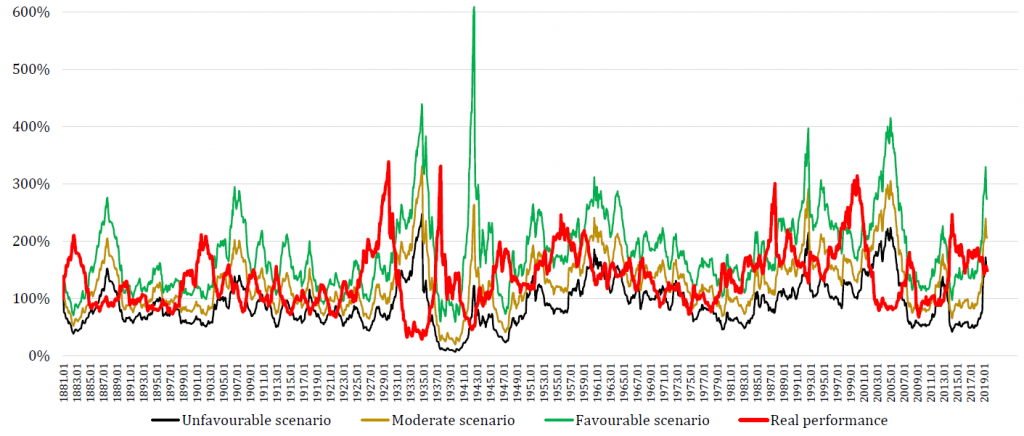

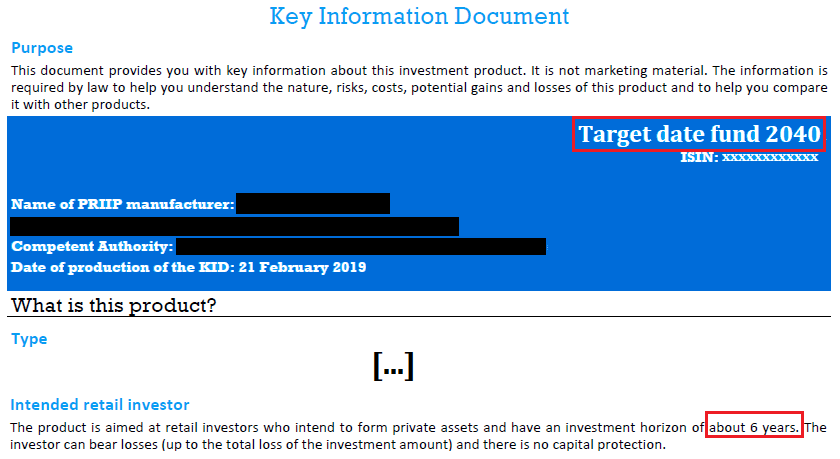

– performance projections: the chosen RHP will affect the intermediary and final future return projections shown in the KID;

– performance projections: the chosen RHP will affect the intermediary and final future return projections shown in the KID;