Risk

3 out of 7

The risk class of this product is medium.

No product is without risk – lower risk doesn’t mean no risk.

Performance

180%

This product returned on average €80 for every €100 invested in the past 10 years (180%).

Costs

INVESTMENT OBJECTIVE

This product aims to increase the value of your accumulated capital and provide you with additional income at retirement by investing in a diversified portfolio of equities (shares, units in UCITS and UCITS ETFs) bonds, real estate and other securities, such as cash or money market instruments) issued or listed on regulated trading venues in the European Union. The investment strategy is based both on a direct and indirect exposure to the types of financial assets described above. Your cash contributions (accumulated capital) will be used to buy and hold the abovementioned types of financial assets that will generate positive investment returns.

Target investor

The long term retirement and cross border nature of this product makes it particularly attractive to young people and mobile workers in the EU. This product is, in general, suitable for those wishing to gain exposure to investment markets, willing to assume some level of risk, those who can bear an investment loss and are willing to invest for a longer period of time Savers have to be prepared to accept that there will be fluctuations in the value of their pension pot and that it may fall in value.

Capital guarantee

Ο Capital protection: net of fees and before inflation

⊗ No capital protection

Risk-mitigation technique

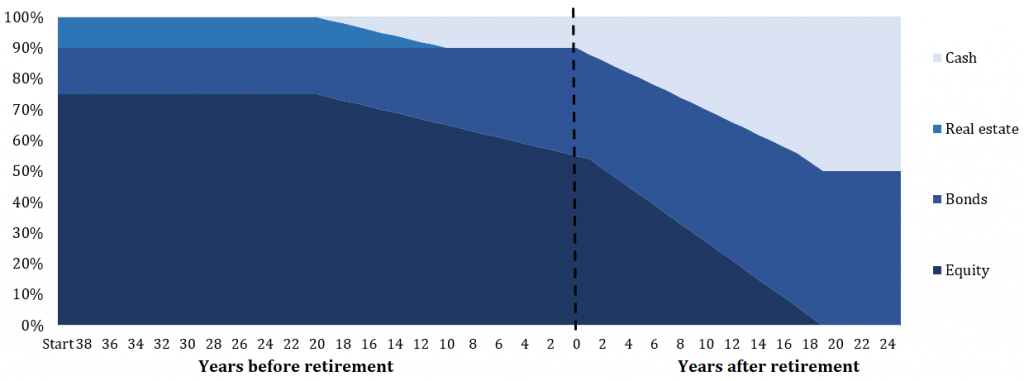

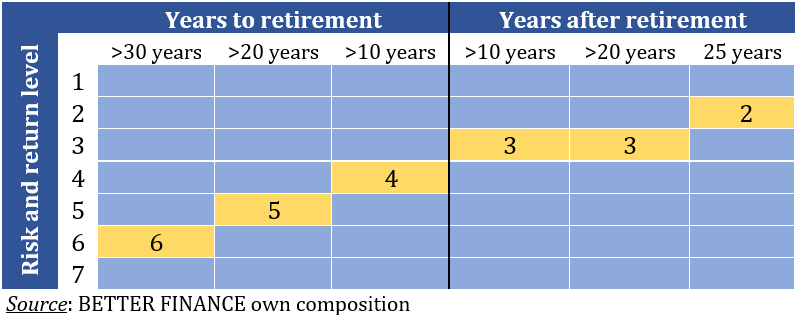

This product uses a life-cycling de-risking technique in order to ensure an optimal risk-reward profile for you.

Explanation: Life-cycling employs a strategic reallocation of your capital from riskier to safer assets in order to maximise returns in the earlier stages of the product and ensure stability and growth in the later stages of the product. A target allocation is applied to the assets, which will change over time according to the reallocation strategy and glidepath. At its launch, the fund has a significant stock component, which on the long-term allows for an optimised risk-return profile. Towards the retirement date, and during the decumulation phase, the majority of your capital will be held in safer assets and in cash, to allow for pay-outs without losing value or your uncalled capital. The stock component is invested in a selection of shares issued by Eurozone denominated companies or share-related investments that may come from the Eurozone. The bond component includes long-term bonds, bond-related investments and money market instruments. The real estate component may come from any region, sector or theme. The glidepath of the asset reallocation is as shown in the graph above.

This product takes into account ESG factors when selecting the companies from which it invests in transferable securities issued by.

Risk indicator

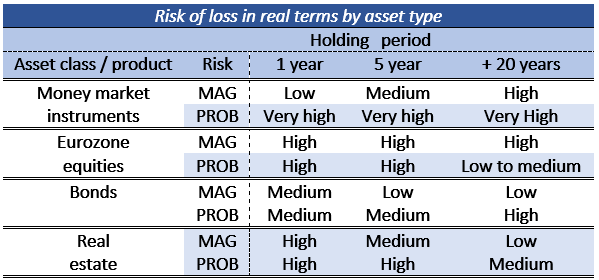

The summary risk indicator shows how likely it is that the product will lose money because of the investments made directly (in securities) or indirectly (in other investment products) or because we would not be able to pay you, and what the magnitude of the loss may be in real terms, meaning after taking into account the effect of inflation. The level of risk is measured by asset class and investment horizon.

*MAG = magnitude; PROB = probability.

*MAG = magnitude; PROB = probability.

As the product has a long-term investment horizon, the risk class of this product varies over time.

The risk profile of this product should decrease over time due to the risk-mitigation technique (life cycling) used. We have classified this product as 6 out of 7 in the first ten years of the accumulation period, which is a high-risk class, after 20 years a 5 out of 7 (medium-high), after 30 years 4 out of 7 (medium). In the decumulation phase, the first 20 years are classified as 3 out of 7 (medium-low) and the last 5 as low risk. This product does not include any protection from future market performance so you could lose some or all of your investment. If we are not able to pay out, you will lose all of your capital. You do not bear the risk of incurring additional financial obligations. Consequently, the risk that an issuer can no longer meet its obligations is higher than in an investment that consists only of bonds with an investment grade rating. If investors are in doubt about the creditworthiness of the issuers of the bonds, the value of those bonds can fall.

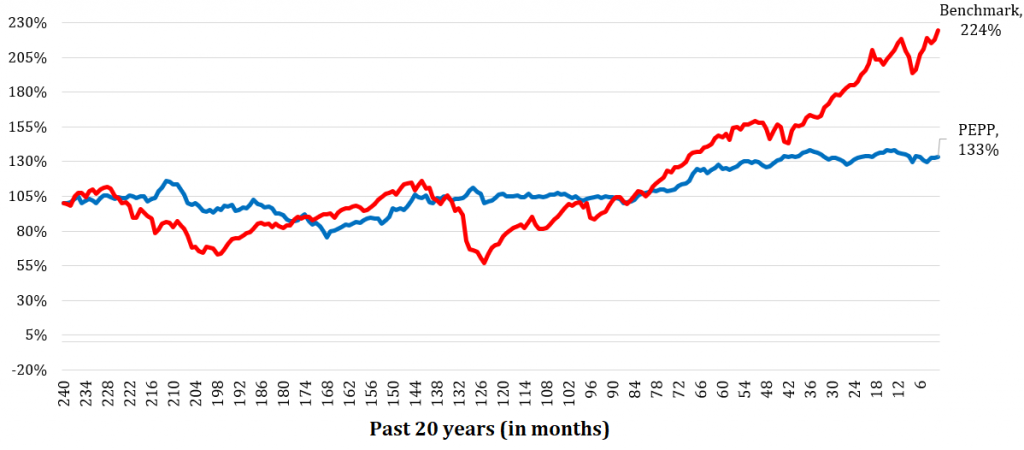

Past performance

Performances presented below are calculated after deduction of all fees charged by the Fund, and after taking into account the cumulative effect of inflation over time.

The Fund was launched on [DD/MM/YYY].

The reference currency is the [currency (symbol)].

The benchmark index is: [benchmark].

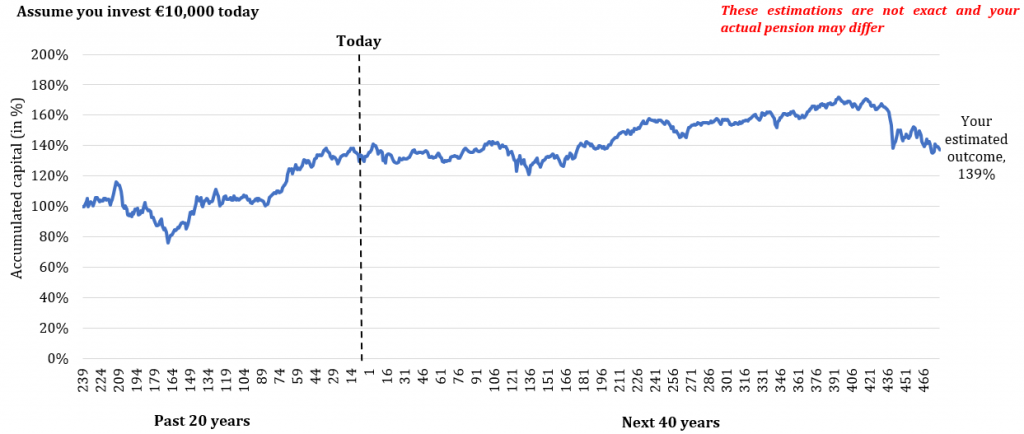

Pension projections

This table shows the money we expect you could get back at the target retirement date of the product [year], assuming that you invest 10000 [currency (symbol)]. The two scenarios shown illustrate the maximum profit and loss we expect your investment could generate and are not an exact indicator. The scenarios presented are an estimate of future performance based the product’s past performance and take into account the potential impact of inflation.

What you get will vary depending on how the market performs and how long you keep the product/investment. The figures shown include all the costs of the product, but do not take into account your personal tax situation, which may also affect how much you get back

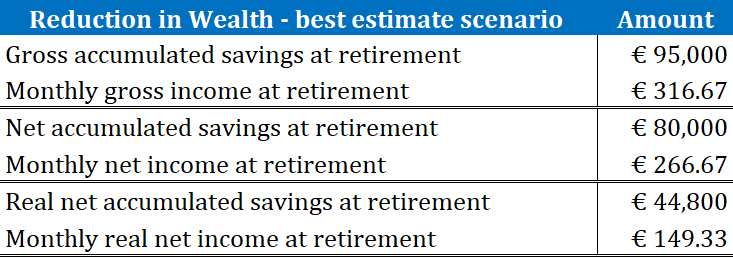

This table shows you the reduction-in-wealth (RiW) which measures how much your accumulated capital (contributions + investment returns) will be reduced by the fees we will have had charged by tme time you retire. The graph presents your accumulated capital in gross terms (before fees), net terms (after fees) and real net terms (after fees and inflation are taken into account).

The second line in each category shows what you would get per month as pension payment from this PEPP, if you should choose so. It uses a longevity assumption of 25 years and that you would withdraw equally each month.

Requirements for the pay-in phase

According to Belgian legislation, the statutory retirement age is 65 years for women and 67 years for men, and a complete career (vesting period) is of 45 years. Pension contributions are not taxed during the pay-in (accumulation phase). There is no minimum amount or continuity requirement of contributions to benefit of pay-out under this product. Contributions into this PEPP will be eligible for a tax exemption and deductible from the income tax. If your annual contributions are below 960€, you will benefit of a tax relief rate of 30%. If your annual contributions are equal or higher to 960€ and lower than 1,230€, you will benefit of a tax relief of 25%. However, in order to benefit of reduced taxation on your pay-outs (see below) you must hold this PEPP at least 10 years and make at least 5 contributions.

Requirements for the pay-out phase

This basic PEPP fall under the pension savings fund category of the Belgian Pillar III. You have the freedom to choose how the pay-outs of your accumulated contributions will be performed: lump-sum pay-out, limited drawbacks or periodical payments, or a mix of the latter. Your pension benefits are subject to a tax rate of 8%. You can start withdrawing from your basic PEPP at the age of 60. If you withdraw earlier than the age of 60, your accumulated capital will be taxed under the personal income tax system. If you choose to start withdrawing between the ages of 60 and 64, you will be subject to a 33% tax on accumulated capital. If you choose to withdraw at or after the age of 65, your accumulated capital will be subject to a tax rate of 8%. This product does not constitute pension reserves, thus the tax on reserves is not applicable.

Complaints about the PEPP, the PEPP distributor or provider

You can submit any complaints you may have by e-mail to complaints@website.be or, by telephone on [number] or [number]. The full complaints procedure is available at [web address].

Alternative Dispute Resolution

In accordance with the relevant provisions of the [PEPP contract/ General Terms and Conditions], in case that you do not receive a response to your complaint within the specified time-frame or that the response is not satisfactory, you may address your to the [ADR body] against the PEPP provider or distributor. You can contact the [ADR body] by e-mail (addres@website.be) or by telephone (number) or via physical mail at [address].

Online DIspute Resolution

You may also submit your complaint to the online dispute resolution bodies (ODR) registered in Belgium or in your Member State of domicile. The find out the ODR bodies registered in Belgium, visit https://ec.europa.eu/consumers/odr/main/?event=main.home.selfTest.

Redress measures

In accordance with the Directive (EU) 2019/XXXX on representative actions for the protection of the collective interests of consumers, you may file a complaint to the authorised entities in your Member State of domicile in order to obtain judicial injunctions and redress (compensation) measures. For more info, visit [web address]. You may also file an individual action yourself in accordance with the provisions of national law in your Member State of domicile.

You can use this PEPP in Belgium, Netherlands, Luxembourg, Spain, Portugal, France and Italy.