BETTER FINANCE finds that commission-based distribution models (kickbacks) cost individual investors up to 15% of their investments in sales commissions and generate conflicts of interest which severely hurt their performance.

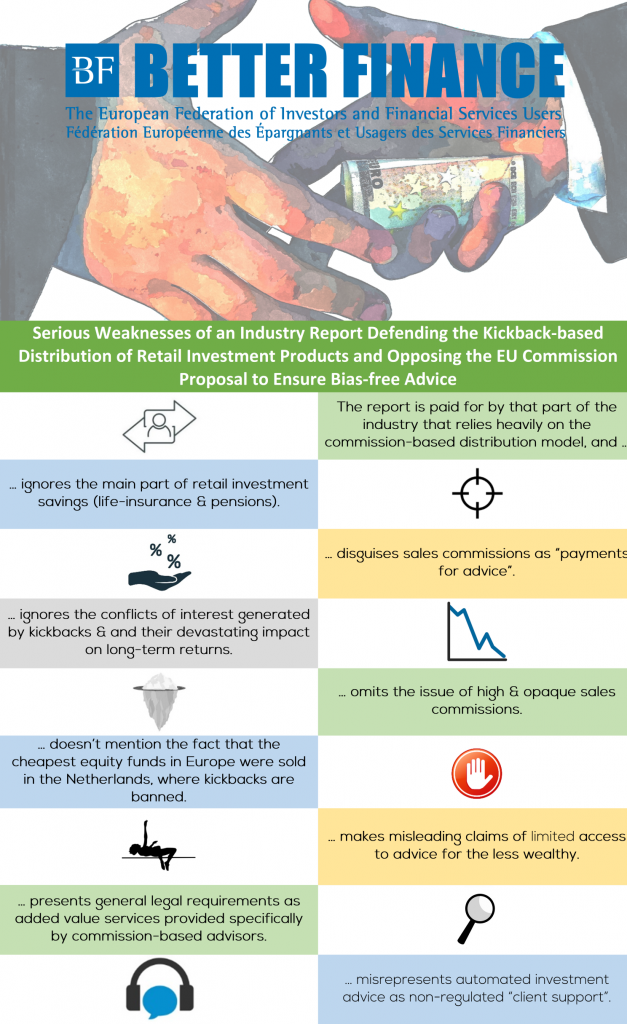

One of the main objectives of the European Commission’s “EU Strategy for Retail Investors” is to “ensure bias-free advice” for individual investors. It is meeting with considerable resistance from many players of the financial industry, as evidenced by a recent report and the ongoing “smoke and mirrors” campaign to counter the EC’s efforts. It befits BETTER FINANCE then, through its own independent research, to clearly demonstrate how the commission-based distribution model is damaging net returns for individual investors.

One of the main objectives of the European Commission’s “EU Strategy for Retail Investors” is to “ensure bias-free advice” for individual investors. It is meeting with considerable resistance from many players of the financial industry, as evidenced by a recent report and the ongoing “smoke and mirrors” campaign to counter the EC’s efforts. It befits BETTER FINANCE then, through its own independent research, to clearly demonstrate how the commission-based distribution model is damaging net returns for individual investors.

The reports have been discreetly circulated to public authorities as part of a large lobbying campaign by several industry associations in the four largest EU economies, to pre-empt EU policymakers from putting a proposal to ensure bias-free advice on the table. Surprise, surprise, no organisations representing independent advisors or other anti-kickback investment firms were included or even surveyed.

- This recent industry-sponsored report bears severe weaknesses indeed. Read the full Press Release below.