Last week, the fund industry warned that “the EU is putting the interests of exchanges over investors”.

A letter from EFAMA to the EU Authorities regarding the reform of EU rules on capital markets (“MIFIR Review” in EU jargon) opposes the compensation of securities exchanges for communicating their trade data to “dark” competitors and labels it as a “subsidy”. This actually disregards and hurts investors, especially EU citizens as non-professional individual investors. It would also hurt SME financing on equity markets where “retail” investors currently play a much bigger role than in the “blue chips”.

Indeed, asset managers (“other people’s money”) are not investors. Rather, they manage assets for investors, those who bear the risks and reap the rewards (net of fees) of investing. And end investors are mostly “retail” ones: EU citizens.

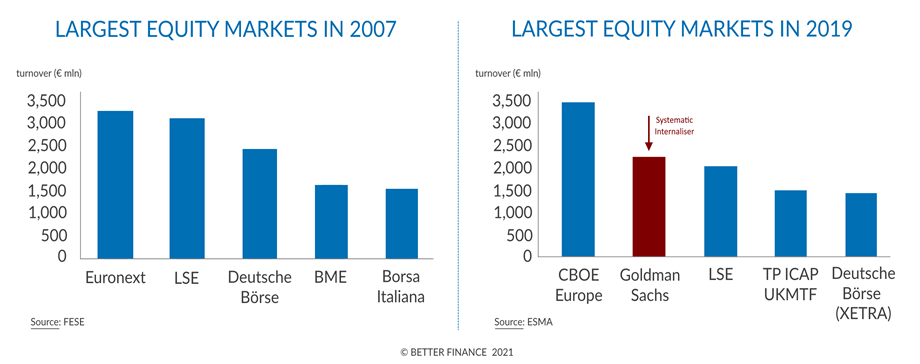

These demands from asset management companies would further discriminate against EU citizens as retail investors, and further crowd them out of capital markets, by once again favouring “dark” capital market venues instead of “lit” regulated markets (the securities exchanges), thereby hampering price formation and depriving retail investors of free, easily accessible, intelligible and transparent trade data provided by regulated markets[1]. This would be a further blow to EU regulated markets that would come on top of the recent and damaging evolution for EU retail investors, whose orders and trades are increasingly directly or indirectly captured by the well-named “dark” venues:

This is a danger for the well-being of pension savers and middle classes who are about to be deprived of a real choice between:

- the dominant fee-laden and too often complex and ill-advised intermediated “packaged” retail investment products on the one hand,

- and the direct, simple, and cost-efficient capital market instruments such as listed equities, bonds, and index ETFs on the other.

| Read or download the full Press Release below |