Key Priorities for 2024-2029 | Sustainable Value for Money: Reconciling Individuals, Enterprises & the Planet

Despite significant efforts, the EU Parliament and Commission must be more ambitious in addressing low participation in local capital markets, a threat to the financial well-being of EU citizens and the competitiveness of the EU economy. Since 2008, EU capital markets have diminished in significance compared to the United States.

Growing problems in national pension systems, particularly from underperforming and complex products, hinder the well-being of European citizens. To enhance competitiveness, EU capital markets need to be deeper, more integrated, and citizen-centric, requiring increased competition, market efficiency, integration, and better outcomes for investors.

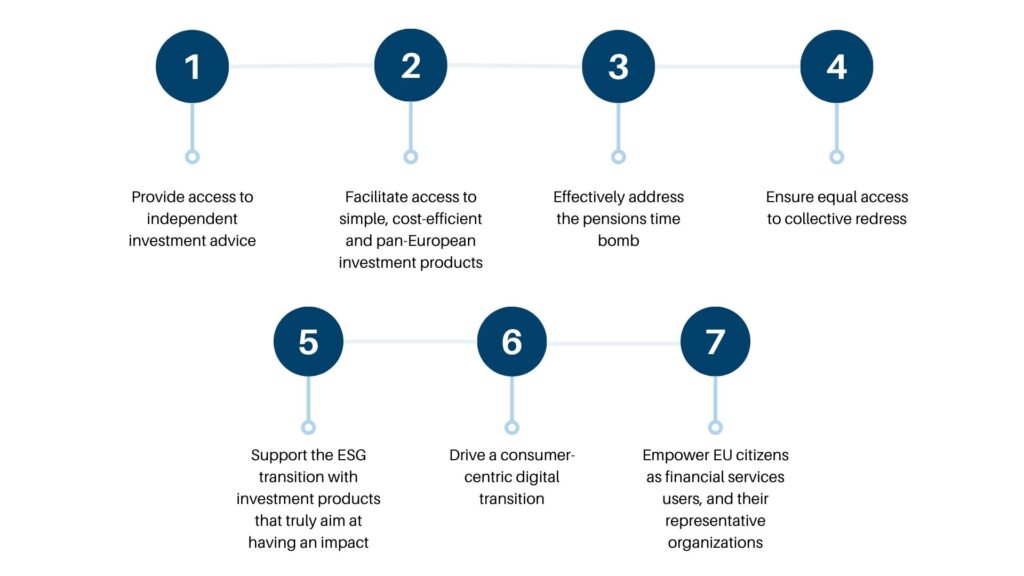

To make EU capital markets more competitive and attractive for citizens and enterprises, a CMU that works for people, BETTER FINANCE has laid out 7 key priorities: