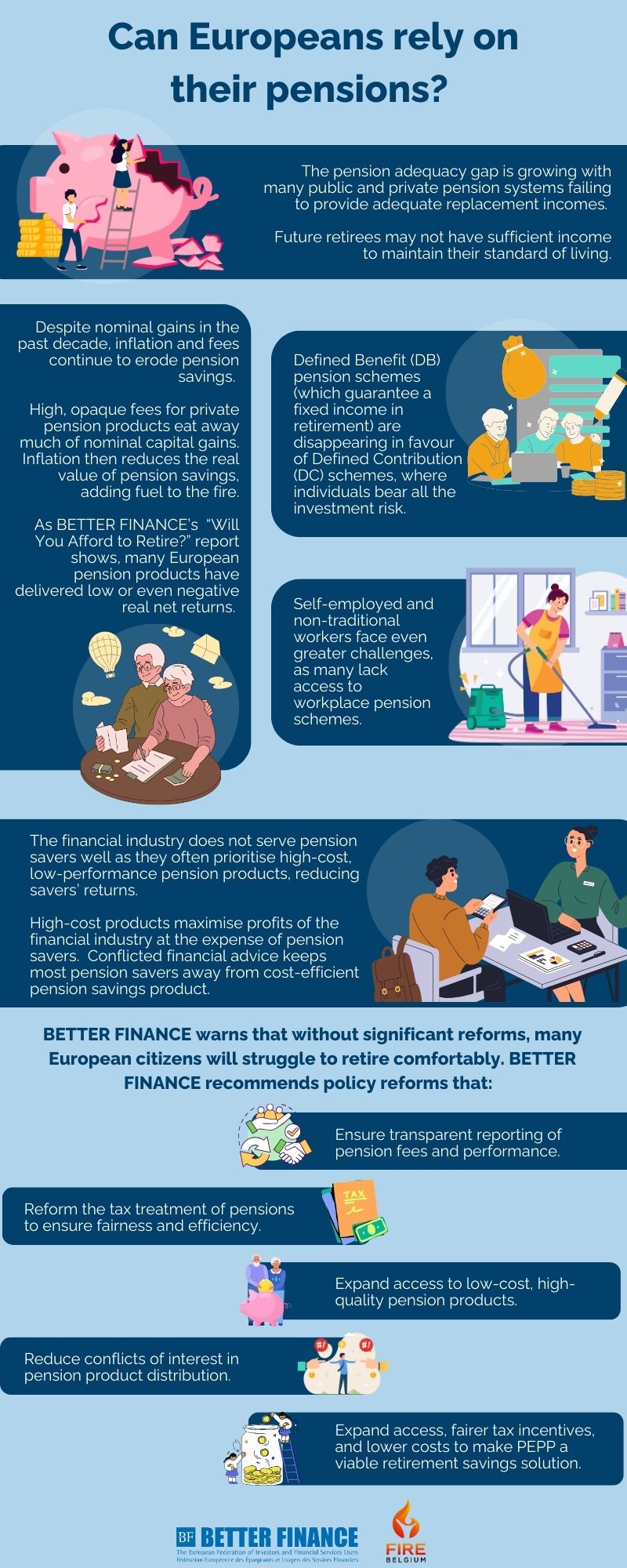

For everyday Europeans, the “journey” into the capital markets is far from being straightforward. Instead of a clear and empowering path, investors face a maze of fragmented rules, opaque products, and inconsistent safeguards.

This leads to a crossroad with two outcomes:

⛔Discouraging citizens from investing in capital markets

⛔Locking them into low-yield savings accounts or costly, underperforming products.

As the independent voice of individual investors and financial services users, BETTER FINANCE welcomed ESMA’s interest in understanding how citizens engage with capital markets and what prevents them from doing so.

In our consultation response to ESMA, we draw on insights from our national members and independent research to show how the current investor journey is failing citizens, and what must be done to rebuild confidence.

To understand the key challenges that European individual investors face and the key recommendations that BETTER FINANCE submitted to ESMA, read the article or check the infographic.