CONSOB, the Italian financial watchdog, invited me on November 8, 2019 to comment on their very interesting 2019 report on the behavior of Italian savers.

CONSOB, the Italian financial watchdog, invited me on November 8, 2019 to comment on their very interesting 2019 report on the behavior of Italian savers.

Several findings were indeed thought-provoking.

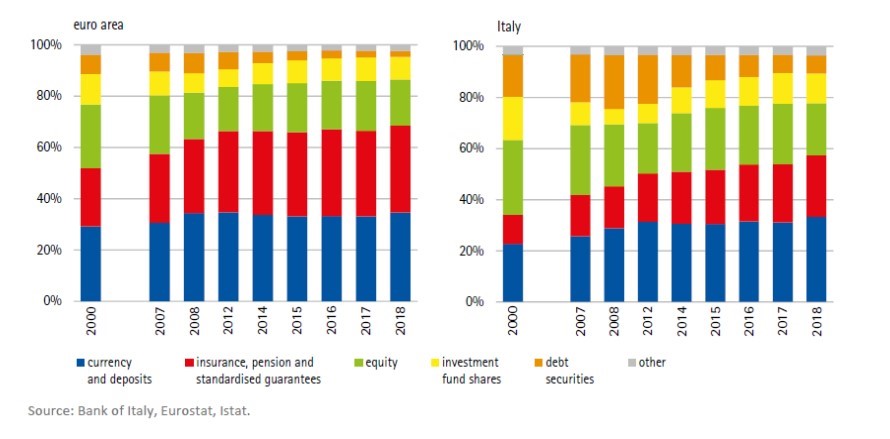

For example, 63% of Italian savers are loss averse according to the Report. However, their top choice (and more and more so) is bank accounts. Those have been – on average - steadily destroying the real value of Italian bank savings (their purchasing power) for years after deducting the impact of fees and inflation. And it is getting worse with interest rates going further down. In 2018, Italian savers also poured more money into life insurance at a time when the majority of guaranteed life insurance contracts also started to generate negative net real returns to their holders. The worst thing is that they are not even really aware of it.

Appropriate and compliant disclosures?

Appropriate and compliant disclosures?

This raises serious concerns about the transparency of disclosures and warnings on performance and fees of “packaged” savings products. Are mandatory key information documents and summary prospectuses really focusing on such key information, are they fully complying with the legal requirement to be “fair, clear and not misleading”? Are they read by savers?

Mis-selling?

It also raises the question of potential misselling: savings products are more “sold” than “bought”: how come retail financial intermediaries let this happen? After all, doctors do not prescribe pain relievers that have a track record of increasing pain, do they? For example, would intermediaries and regulators be nurturing – rather than fighting - the “monetary illusion” of savers? Economists call “monetary illusion” the fact that most citizens are not really aware of the severe negative impact inflation (even with today’s low levels) has on their savings over time. Indeed, legal disclosure requirements on actual returns in the EU - when they exist – regard only nominal – not real - ones, even for long term and pension savings products.

Conflicts of interests?

On the other hand, Italian savers have dropped out quite massively in recent years of listed equities and bonds and have never really saved into low cost index funds: all products that have delivered positive net real returns as a whole since the beginning of this century. Most Italian savers do not even know that most of their “advisors” are paid for selling specific products to them (not for advising)? Those commission-generating products do not include listed equities and bonds and low-cost index funds. So, savers rarely - if ever - learn about them and about their potential advantages at the point of sale. Isn’t it time to call a cat a cat, and clarify this “non independent advice” (as EU rules name them) as “sales pitch”? The UK and the Netherlands went a step further and banned such sales commissions to retail advisors. But, taking a big step backward, France just lifted its 15-year-old ban of sales commissions for the main French personal pension products.

The “Next CMU” report, released last month and sponsored by the Governments of Germany , the Netherlands and … France (and with contributions from Italy), calls for “fair advice”. Let’s hope this time such calls will turn into actions.