“It is the innate conservation of the people that has kept our money good in spite of the fantastic tricks which financiers play - and which they cover up with high technical terms.

The people are on the side of sound money. They are so unalterably on the side of sound money that it is a serious question how they would regard the system under which they live, if they once knew what the initiate can do with it.” - Henry Ford, My life and Work, 1922

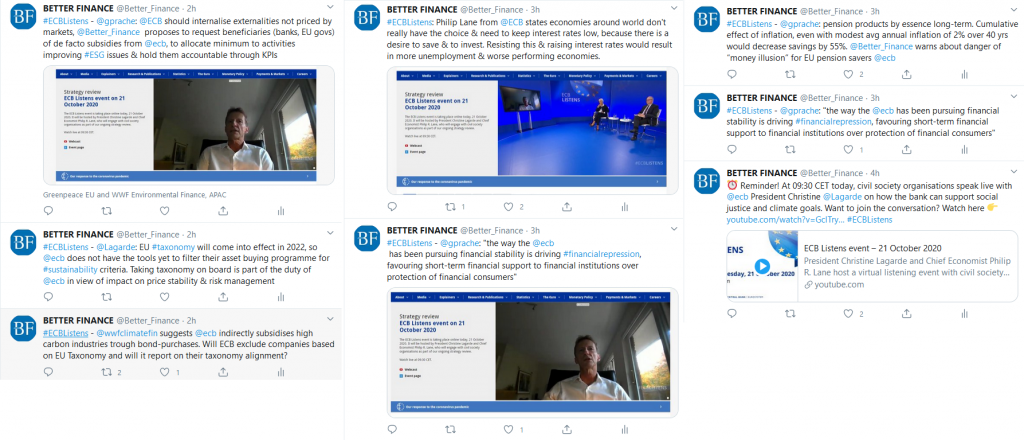

BETTER FINANCE thanks the European Central Bank (ECB) for its initiative to reach out to EU citizens as users of financial services and to “civil society” at large. We acknowledge the major role the ECB has to play in addressing many short-term issues arising from the 2008 financial crisis and, today, from the Covid-19 one.

BETTER FINANCE thanks the European Central Bank (ECB) for its initiative to reach out to EU citizens as users of financial services and to “civil society” at large. We acknowledge the major role the ECB has to play in addressing many short-term issues arising from the 2008 financial crisis and, today, from the Covid-19 one.

- Financial repression at unprecedented highs: middle classes to eventually foot the bill

We do support price stability of course. However, in pursuing it, the ECB has been leading the charge of an unprecedented “financial repression”[1]. We believe the ECB bears responsibility in the impoverishment of pension savers, and does so without disclosing this to them.

Indeed, we are concerned that the ECB deliberately favours short-term financial support to banks and governments over saver protection[2], and did so even before the Covid crisis. We agree that the short-term priority in times of crisis should be employment and growth. However, the current ECB policy - with its negative interest rates and capital requirement rules - results in huge subsidies to banks and to Governments, that are not conditional on being used towards employment and growth, with performance indicators. We believe the ECB should not sacrifice pension adequacy and EU citizens as long-term savers for this short-term priority, and should pay more attention to the protection of pension savers (who comprise a very large part of the population) and other long-term investors, when determining the interest rate and monetary policy; especially after the “critical” phase of a crisis has passed.

The ECB's Chief Economist mentioned a 2% inflation target. Over 40 years, this means that a nominally guaranteed pension savings pot will lose 55% of its purchasing power / real value: the ECB is thus exploiting the “monetary illusion” many pension savers live under.

It is not only an economic and social issue, it is also a democratic one. If the sinister 1930s are any guide, financial repression and sacrificing small savers and individual investors means destroying the lifetime savings of the middle classes, and the most worthy ones. And the middle classes are the main pillar of any democracy. Sacrificing them is likely to lead once more to the rise of anti-democratic forces, violence and misery.

- Banks have become highly subsidised

Unprecedented money creation and negative interest rates make banks very dependent of the ECB. Banks have become heavily subsidised by the ECB, and very dependent upon it. What does the ECB get in return? And what about EU citizens? In addition, there is no clear and explicit disclosure to citizens about these de facto subsidies, or their total amounts or broken down by beneficiary. Please use plain English to disclose the volume and price of ECB subsidies to banks to EU citizens: loans or government bond purchases at -0,5 to -1%, represent billions of Euros of direct subsidies without any collateral from the beneficiaries, the privately owned banks. This is quite unique in as far as subsidies granted by a Public Authority are concerned. Also, these private commercial interests are the only beneficiaries of these subsidies, not EU citizens. Where is the ethical basis?

- … with no collateral provided by the beneficiary banks

Indeed, what is preventing these banks from simply enjoying these billons in public subsidies and just sit on their central bank debt for which the ECB pays them a de facto commission? In particular, balance sheets of major EU banks are increasingly directed to forex and interest rate derivatives, in such staggering quantities that no longer bear any relation to the real economy and world trade: 13 billion USD are traded every day in forex and interest rates derivatives, of which more than 90% by financial institutions alone. What is the benefit for the real economy, for EU citizens? Why is the ECB increasingly de facto fueling this, and apparently not acting on these mammoth, mushrooming purely financial transactions, which are, for good measure, exempt from financial transaction taxes, contrary to the much smaller equity transactions by non-financial investors?

- ECB funding of governments through the printing of money grows

The ECB is increasingly funding national governments via direct purchases on the bond markets and via requirements for banks to provide collateral securities to get the subsidised loans. Again, we suspect a very large part of this collateral to be EU government bonds. We ask the ECB to clearly tell EU citizens how much of each EU Government debt it owns – total and by Member State - and how this is funded. These bond holdings are rather unlikely to ever be paid back. What would happen if the ECB depreciated those?

- Is the Sovereign bond market still a market...

...when the ECB sets (very artificial) prices? The eurozone public deficit for 2020 is forecasted to be around 9%, yet the ECB applies negative interest rates on their debt. What is the share of the ECB in sovereign bond market trades, direct and indirect?

- The ECB is also a benefactor to bond dealers

The ECB is still not allowed to buy those bonds directly from Governments (on the primary market that is) which forces it to buy and sell those only on secondary markets and to go through private intermediaries: the bond dealers. To what extent is the ECB actually supporting the bond dealers’ business this way? What share of bond dealers’ revenues does it represent? How does it ensure fair competition in this market where it is probably a increasingly dominant player? There again, EU citizens would welcome a clear disclosure of the facts.

- ECB Governance issues

The governing bodies of the ECB do not include Independent members.

We also concur with the conclusion of the Report of the NGO CEO : « The lack of institutional oversight of the ECB within the EU’s decision-making infrastructure may help to explain why the expanding mandate of the ECB has not been matched by a parallel development of its ethics rules. But the independence enjoyed by the ECB makes it all the more important to deal with the danger of regulatory capture posed by the advisory groups” [3] . A lot of private bank executives populate these advisory groups, with almost no representatives from civil society organisations.

One example is in the area of shareholders rights: the AmiSeco (Advisory Group on Market Infrastructures for Securities and Collateral). Its full members seem to include only private financial intermediaries – including non-EU ones - and Public Authorities, without members representing the user-side of securities markets - in particular EU citizens as individual investors. Also, it seems that it has already been decided that the newly created AMI-SeCo sub-group “Corporate Events Group” will be co-chaired by two financial intermediaries, and the existing subgroup on corporate actions is already chaired by a US bank executive. BETTER FINANCE has written a letter[4] to the ECB pointing to these issues and asking to improve the governance of these groups.

- Sustainable ECB finance

As “secondary objective”, the ECB should definitely help internalise critical “externalities” not priced by markets (rightly pointed out by Greenpeace as well[5]), in particular environmental externalities. We propose to request the beneficiaries (private banks and EU Governments) of its de facto subsidies (”negative” interest paid by the ECB on its loans to banks and on government bond purchases) to allocate a minimum % of these subsidies to support activities that improve ESG issues and hold these beneficiaries accountable by requiring reporting on key ESG improvement indicators. Citizens want real results and impacts, not “greenwashing”. In this respect, we agree with Ms. Lagarde that the EU “taxonomy” needs to be continuously improved.

And again, EU citizens have a right to clearly know the total amounts of these huge subsidies, as well as the amounts by beneficiary: i.e. by each private bank or Member State.

[1] The term “financial repression” was introduced in 1973 by Stanford economists Edward S. Shaw and Ronald I. McKinnon. Financial repression comprises policies that result in savers earning returns below the rate of inflation to allow banks to provide cheap loans to companies and governments, reducing the burden of repayments.

[2] https://www.rtl.fr/actu/politique/la-croissance-mondiale-est-precaire-et-fragile-affirme-christine-lagarde-sur-rtl-7799354151

[3] https://corporateeurope.org/sites/default/files/attachments/open_door_for_forces_of_finance_report.pdf

[4] Attached as annex.

[5] Greenpeace - New economy Foundation report