Brussels | Press Release

The European Securities and Markets Authority (ESMA) has just released its annual report on the costs and performance of EU retail investment products. While the report is a valuable tool for assessing market trends, its findings once again highlight the persistent shortcomings that leave EU individual investors at a disadvantage.

Underwhelming Performance: Individual Investors Struggle to Preserve Wealth

ESMA’s analysis reveals that over the past five years, the real (inflation-adjusted) performance of EU retail investment portfolios has barely managed to maintain their value. In reality, only 9% of EU household financial savings are invested in UCITS and AIF funds supervised by ESMA, with a staggering 70% of EU retail investments falling under EIOPA supervision—highlighting the need for broader oversight.

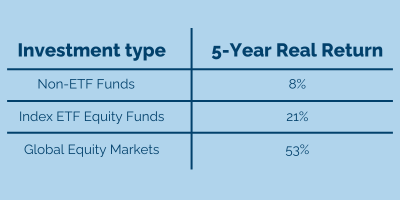

Most concerning is the stark underperformance of non-ETF equity funds, which delivered only +8% over the last five years to 2023—six times less than the +53% return of global equity markets. ESMA also confirmed the superior performance of index-based ETFs, which outpaced actively managed equity funds by a factor of more than two (+21% vs. +8%).

High Costs Persist Despite Market Inefficiencies

While ESMA notes a marginal decline in UCITS fund costs, these remain high compared to global standards. ESMA points out that EU funds, with an average fund size ten times smaller than US mutual funds, fail to leverage economies of scale—exposing the inefficiencies of the European market.

The added value of fund management is further questioned when comparing returns: mixed funds, which charge fees comparable to equity funds, have once again provided returns barely higher than bond funds.

Fund Performance vs. Capital Markets

The table below illustrates the stark contrast between the returns of fund investments and broader market performance:

A Call for Structural Reform

Aleksandra Mączyńska, Managing Director of BETTER FINANCE, stated: "BETTER FINANCE has long advocated for greater transparency and efficiency in EU retail investment markets. The persistently high costs, underperformance relative to capital markets, and lack of oversight for the majority of household savings highlight the urgent need for reform, particularly within the framework of a future Savings and Investments Union.

We urge EU policymakers to prioritise the interests of individual investors and tackle the inefficiencies that continue to erode returns for millions of savers."

⬇️To download the press release, check below⬇️