Available data and evidence show significant increases in the trading and investing activity of EU households, sparked by a new wave of young, previously inactive, non-professional investors. Many EU retail investors increased their exposure to listed equities and started to invest via execution-only services (brokerage accounts).

Available data and evidence show significant increases in the trading and investing activity of EU households, sparked by a new wave of young, previously inactive, non-professional investors. Many EU retail investors increased their exposure to listed equities and started to invest via execution-only services (brokerage accounts).

Besides flattening the illiquidity curve during the period of market turmoil of February-March 2020 thanks to their “contrarian” behaviour, retail investors offer a large source of long-term funding for the real economy, which will prove pivotal in the recovery from the COVID-19-induced economic effects. In fact, in jurisdictions such as the Netherlands, the majority of households invest themselves (through execution-only channels), which makes this topic all the more important.

As such, EU capital markets face a significant challenge: to make investing and trading on capital markets fair, simple, transparent, easy, and attractive for the new wave of individual, non-professional investors.

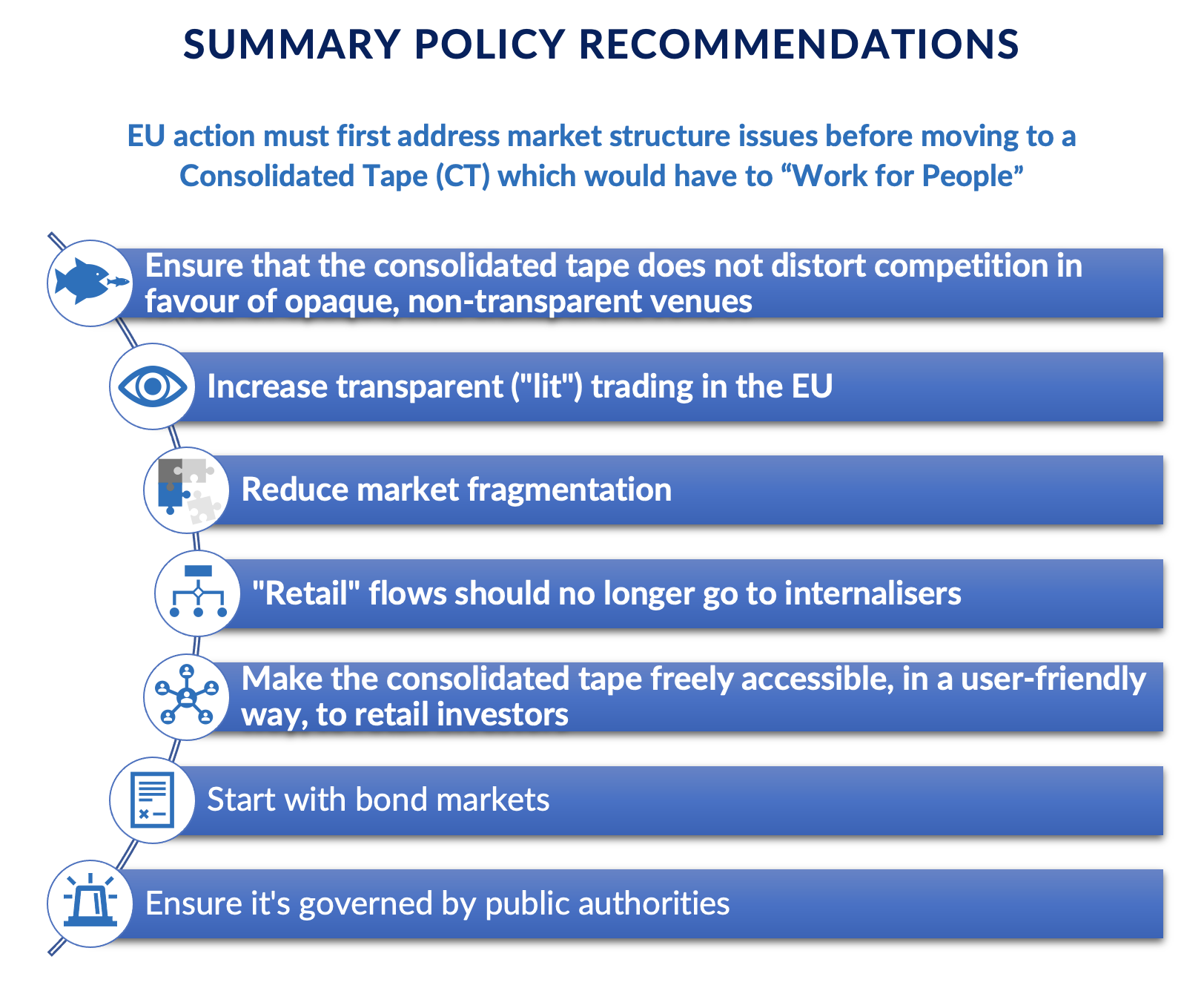

To ensure that investors enjoy optimal outcomes, EU capital markets must foster adequate price discovery and formation mechanisms, which can only happen through “lit” trading of “retail” orders (regulated markets and “lit” multilateral trading facilities). Retail investors must easily access pre- and post-trade data to be able to make informed trading decisions and, also, evaluate best execution on their orders. In practical terms, this translates to a consolidated tape that allows ex-post verification of obtained prices and best execution deals by investors.

- Read the BETTER FINANCE Position Paper below.