A report published on Tuesday 31 May 2022 by the European Securities and Markets Authority (ESMA), confirms BETTER FINANCE’s findings that fund managers often don’t seem to act in the best interest of fund investors when it comes to securities lending.

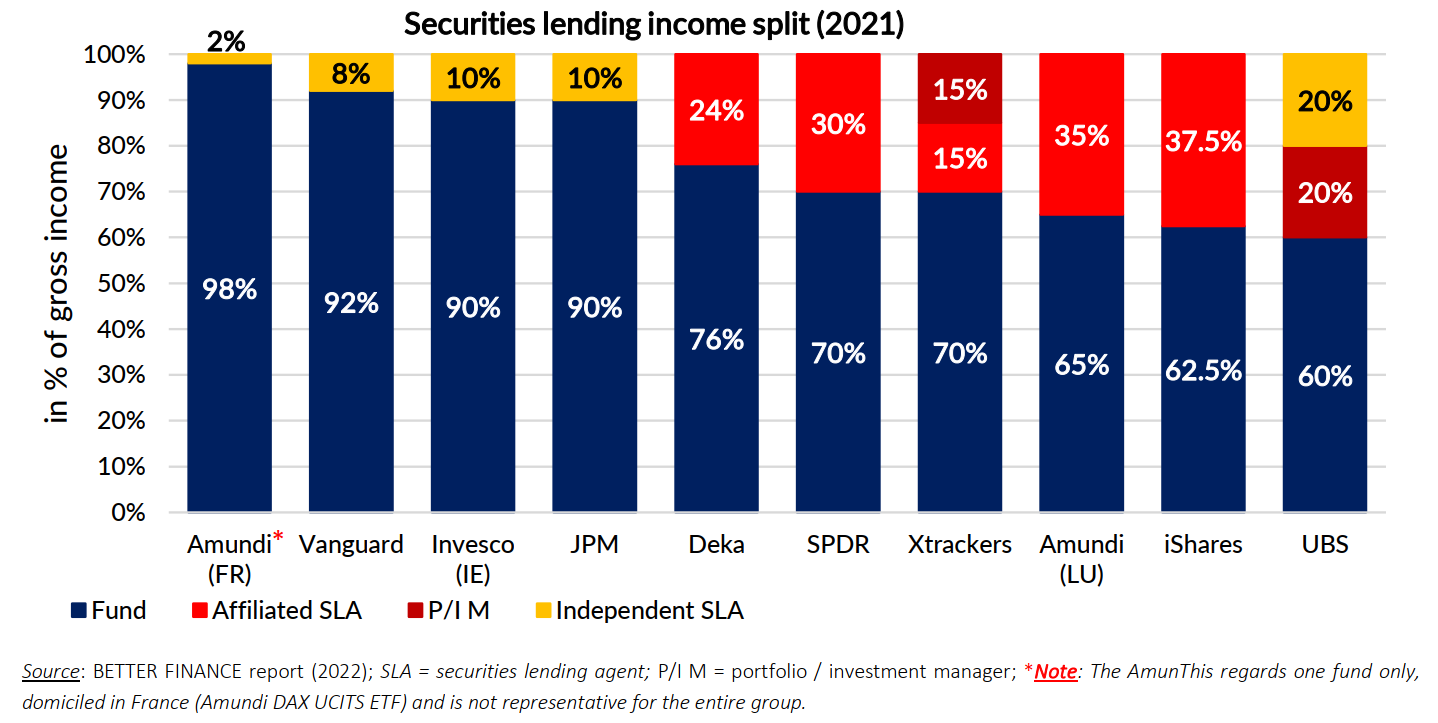

Three years after its first report,[1] BETTER FINANCE expanded on its research into securities lending[2] to once more find that fund managers’ “fee split”[3] arrangements, particularly with in-house agents, vary considerably and may be contrary to ESMA’s Guidelines.[4] Such practices could lead to investor detriment and actually constitute a breach of the generally duty of care[5] towards “retail” fund investors.

EU “soft”[6] law stipulates that securities lending income, net of direct and indirect operational costs,[7] must be returned to the funds’ beneficial owners.[8] The key provision is that these operational costs cannot include “hidden revenues”, reason for which BETTER FINANCE questions why some asset managers can pay as little as 2% of gross income, while others deduct up to 40%.

⬇️ Read the full press release below. ⬇️