Investing in capital markets has been proven to deliver substantial gains in the long term compared to less direct investment products. Yet, Europeans’ money sits mostly in bank deposits (which come with minor returns).

The State of Retail Investment in Europe

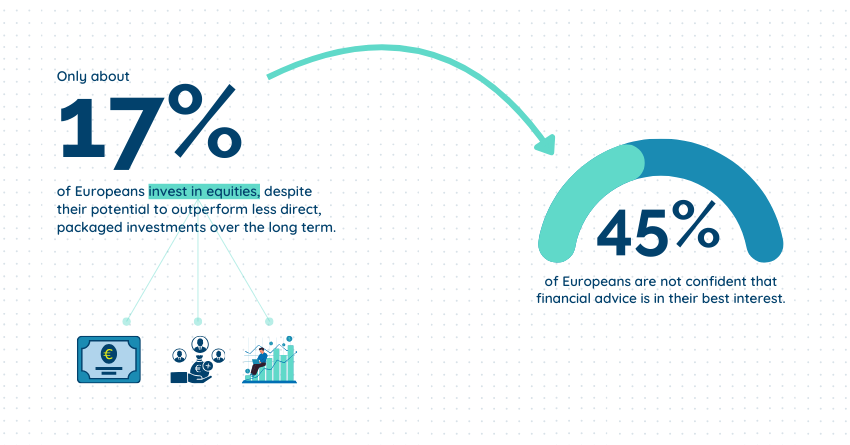

Only 17% of Europeans invest in equities, despite their potential to outperform less direct, packaged investments over the long term.

One of the main reasons behind this is the Europeans’ low trust in capital markets and financial service providers. This lack of trust is further compounded by limited access to independent financial advice. Specifically, 45% of Europeans are not confident that financial advice is in their best interest.

The problem with commission-based financial advice

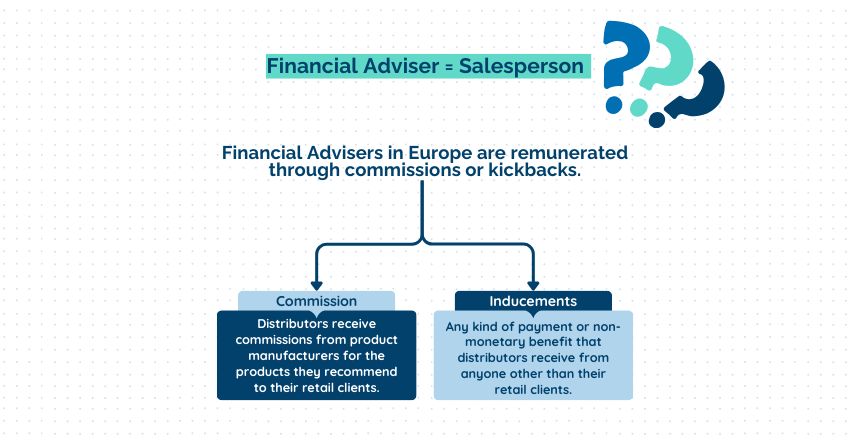

In the EU, retail investors - individuals who invest in securities for personal use- are dependent on advised services and retail investment products which are mainly distributed through a commission-based model.

This can be done either through a commission or inducements. Commissions constitute a fee distributors receive from product manufacturers for the products they recommend to their retail clients. On the other side, inducements include any kind of payment or non-monetary benefit that distributors receive from anyone other than their retail clients.

The bias of earning the highest commission pushes advisers:

- Away from the most suitable products for their clients;

- Towards high-fee products that increase commission.

This creates a climate in which retail investors end up with packaged products laden with fees yielding worse results compared to direct equity investments. In 2021 alone, retail clients faced double the charges (40%) compared to institutional investors.

Retail Investment Strategy

The European Commission aims to address this issue through the Retail Investment Strategy (RIS). Among other things, the RIS’s “best interest of the client” test aims to enhance the quality of financial advice by requiring advisers to:

- Base their recommendations on a broad range of products;

- Recommend the most cost-efficient financial products;

- Offer at least one product without unnecessary features and costs.

Believing in the impartiality of the advisors in their selection of products and the capacity to cater to clients’ needs is crucial to increasing retail investors’ participation!

BETTER FINANCE is the only association that protects the rights of retail investors at the European level. Follow us to be updated on the latest developments in retail investors' rights.

*This article is created as part of BETTER FINANCE’s social media educational campaign to make finance more accessible to Europeans. Check the original post on our LinkedIn page.

To download the original post as PDF, click here.