For the past 12 years, BETTER FINANCE has been revealing the true returns of long-term and pension savings in the EU. Over the past few years, it became evident that the pension situation in the EU is bleak: almost all product categories analysed in the report showed a decrease in both nominal and real terms.

As the report notes, one or even two years' results do not tell us much about the long-term performance of saving products. What matters is for Europeans to be aware of their investment in these long-term products, and make sure they understand how their current investment will translate into the future.

The four main factors that can negatively affect the returns of your pension savings are high fees and charges, inflation, taxes, and misguided asset allocation. Today, we will focus on the impact of pension fees and charges on our retirement savings and provide tips on how to tackle them.

What are pension fees and charges?

Costs and charges within our pension plans play a crucial role in determining savings returns and understanding them is essential for achieving a comfortable retirement.

Pension fees are charges on your pension savings for managing and administering your investments. These include investment fees, contract management fees, and other costs.

How pension fees affect your retirement savings?

Even small fees can significantly reduce your savings over time. For instance, a 1% annual fee might not seem like much, but over 30 years, it can diminish your retirement savings by more than 25%.

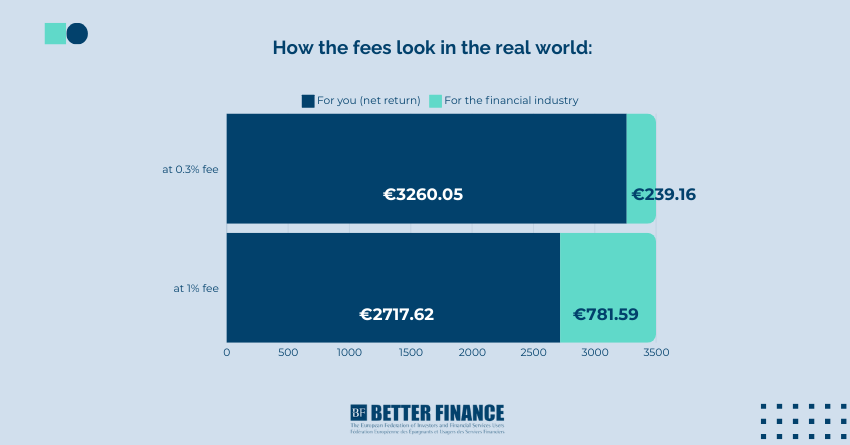

Consequently, higher fees mean lower returns on your investments. For instance, if two pension plans offer the same gross return of 5% over a year, but one charges 1% in fees and the other 0.3%, the net returns for that year would be 4% and 4.7% respectively.

Let’s look at how this looks like in the real world. Over 10 years of saving 100 € a month, the 0.7 percentage point difference in fees would translate into a 542.44 € difference in returns.

How to protect your pension from high fees?

The problem with retirement fees and commissions is that they are often complex, opaque, and presented in various formats. This lack of transparency prevents savers from obtaining essential information to evaluate and compare the performance of pension products.

However, awareness of the fees linked to pension savings can make a substantial difference in securing a comfortable retirement. So, before signing up to a certain pension product, make sure you:

- Compare Fees: Look for detailed information on fees for different pension products.

- Choose Low-Fee Options: Whenever possible, opt for pension plans with lower fees.

- Ask Questions: Don’t hesitate to ask your pension provider about all the fees involved.

*This article is created as part of BETTER FINANCE’s social media educational campaign to make finance more accessible to Europeans. Check the original post on our LinkedIn page.

To download the original post as PDF, click here.