BETTER FINANCE`s 2017 study on the Mis-selling of Financial Products put mis-selling on the radar of the EP, with five recent ECON studies referencing the study as well as quoting BETTER FINANCE`s extensive work on the subject. Also quoted was BETTER FINANCE`s replication of the 2016 ESMA study on closet indexing. Although the fact that research by BETTER FINANCE put mis-selling of financial products at the forefront of debates such as the ECON Public Hearing that took place on the 19th of June building, there is still a long road ahead before a sufficient level of consumer protection in the field of financial services can be ensured.

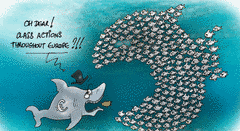

Building on this perception, MEP Sven Giegold of the Greens stated that: “Protecting European retail investors from being sold overpriced or unsuitable financial products still requires great efforts from the EU and member states”, adding that: “The practice of some financial companies to shamelessly exploit inexperienced customers when saving or investing for their retirement must finally be put a stop to”. To read more about the ECON studies on the Mis-selling of Financial Products, please see here:

- Marketing, Sale and Distribution (ECON Study, Mis-selling of Financial Products), June 2018.

- Compensation of Investors in Belgium (ECON Study, Mis-selling of Financial Products), June 2018.

- Subordinated Debt and Self-Placement (ECON Study, Mis-selling of Financial Products), June 2018.

- Mortgage Credit (ECON Study, Mis-selling of Financial Products), June 2018.

- Consumer Credit (ECON Study, Mis-selling of Financial Products), June 2018.