Your shares represent more than just financial assets—they provide you with a voice in the companies you invest in. In fact, they represent your co-ownership of a listed company.

As a shareholder, you have the right to:

- Stay informed

- Vote at Annual General Meetings (AGMs)

- Have your broker or bank facilitate AGM access

- Voice your opinions and ask questions

What is the Shareholders’ Rights Directive II (SRD II)?

This is possible through the Shareholders' Rights Directive II (SRD II) which empowers minority shareholders to actively participate in corporate governance, ensuring their rights are safeguarded and their voices heard.

Under SRD II, you have the right to:

- Participate in AGMs, either on-site or electronically (rules may vary across EU Member States);

- Use proxy voting to have a say if you are unable to attend (independent shareholders’ organisations allow you to pool your voting power);

- Request your Asset Manager to vote according to your preferences (stewardship) of you are a fundholder.

Challenges Faced by European Shareholders

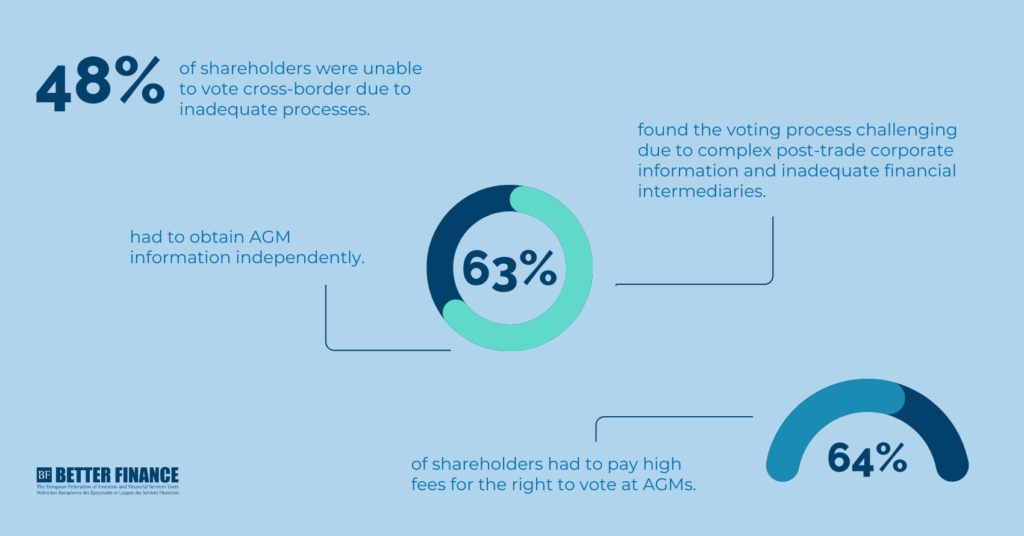

However, many shareholders in the EU continue to face challenges. A study conducted by BETTER FINANCE & DSW in 2022 revealed that only 48% of European shareholders were unable to vote cross-border due to inadequate processes.

Furthermore, 63% found the voting process challenging due to complex post-trade corporate information and inadequate financial intermediaries. The same percentage had to actively seek AGM information independently. At the same time, 64% of shareholders had to pay high fees for the right to vote at AGMs.

The Way Forward for European Shareholders

Shareholders of EU companies deserve more. They deserve a seamless and transparent process to ensure a more efficient and equitable system. Specifically, they need:

- Reduced costs, increased transparency, and enhanced stewardship duties;

- Direct communication between companies and shareholders;

- Simplified and harmonised documentation and deadlines;

- Streamlined digitalisation of the voting process and ensured equal treatment for all shareholders.

**This article is created as part of BETTER FINANCE’s social media educational campaign to make finance more accessible to Europeans. Check the original post on our LinkedIn page.

To download the original post as PDF, click here.