What do platforms like TradeRepublic, BUX, Trading212, Interactive Brokers, Revolut, DEGIRO, BitPanda, and eToro have in common? They are neobrokers or offer digital brokerage services, making investing more accessible and affordable for retail investors across the EU. However, they can differ significantly in their operations and product offerings. Some provide riskier financial products, while certain business models and pricing structures can affect execution quality, influence retail investor behaviour, and ultimately financial outcomes.

Let’s dive into how ‘neobrokerage models’ work – exploring their benefits, pitfalls, and what retail investors should be mindful of.

What are Neobrokers?

Neobrokers are digital platforms that enable individual investors to engage in self-directed (“execution-only”) investing at low stated cost, with minimal account requirements. They provide streamlined access to financial markets, primarily offering stocks and ETFs, with many now including fractional trading; allowing users to purchase ‘slices’ of assets and further lowering the entry barrier. Some platforms also offer access to riskier, more complex products such as cryptocurrencies, derivatives, or leveraged instruments (e.g. CFDs), or other services (e.g. copy-trading) which may not be suitable for all investors.

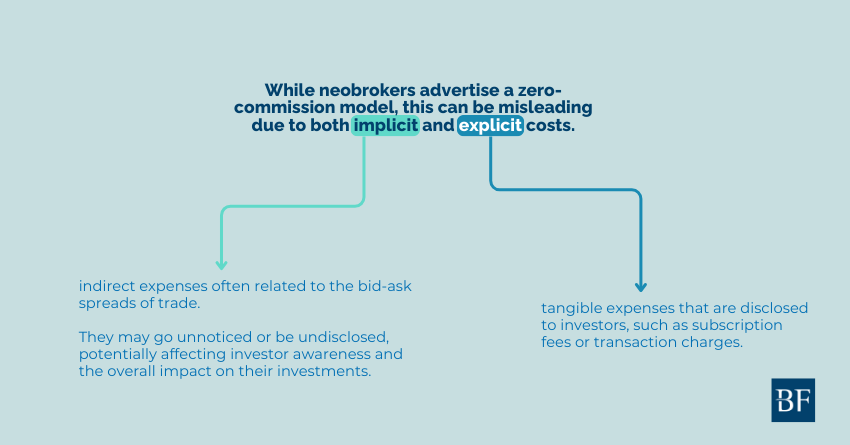

The neobrokerage model’s appeal lies in the promise of low or zero commissions. However, indirect costs remain embedded in their business models, varying in form and degree across platforms. Monetisation strategies can range from trade-routing practices (including spread widening or capturing the buy/sell mark-up) to other sources such as currency conversion fees, securities lending, or premium subscriptions. Importantly, these alternative revenue streams differ in transparency and can significantly influence the overall investor experience.

Neobrokers also leverage technology to reduce their operational costs while fostering user-friendly interfaces. Many are featuring tools such as automated savings plans, recurring orders, and thematic portfolios. While these features can support disciplined investing (e.g. cost averaging), the same platform design – often incorporating gamification, behavioural nudges, or 'one-tap' trade execution – can also encourage reactive or impulsive trading.

These platforms offer remarkable opportunities to democratise investing and engage a new generation of retail investors – but their design, incentives, and evolving business models introduce subtle risks that require awareness.

Challenges of Neobrokers

Despite their clear advantages in democratising market access, neobrokers and digital brokers present subtle challenges for retail investors. The ‘low/no-commission’ model can be misleading, as hidden (implicit) costs often apply beyond disclosed fees. Service limitations may also arise; such as limited tax support, client service, shareholder rights, or access to market information.

* Hidden Costs (Implicit): These less obvious costs are indirect expenses that can affect your returns. They include:

- Bid-Ask Spread (and Execution Quality): The difference between the buying and selling price of a security. Combined with how orders are routed or prioritised, this affects the final price you receive.

- Ancillary Transaction Charges: Costs incurred in the course of transactions that are not always clearly labelled as 'fees' – for example, currency conversion mark-ups, retained interest on uninvested cash, or revenue from securities lending not shared with the investor.

- Opportunity Costs: Potential earnings or advantages lost due to suboptimal platform features or practices—such as poor interest rates on cash balances, etc.

* Clear Costs (Explicit): These are the fees neobrokers typically disclose upfront. They may include:

- Subscription Fees: A regular charge to use the platform or access premium features.

- Transaction/Execution Charges: Fees for specific trades, or to access certain complex / foreign instruments.

- Account Maintenance/Custody Fees: Ongoing charges for holding and servicing your investments.

Note on Execution:

Neobrokers may restrict access to public trading venues by internalising client orders; either matching them with other clients or using their own inventory. While this can reduce explicit costs and offer speed, it may bypass transparent exchanges and result in less favourable asset pricing. Internalisation can also introduce counterparty risk, especially when trades are not settled through a central counterparty. Investors should be aware of these trade-offs when assessing execution quality.

Inducement and Conflict of Interest

Another key concern with some neobrokers platforms is the use of inducements (or ‘kickbacks’) – benefits such as payments or rebates received for directing trades or promoting specific products. These create potential conflicts of interest and risks for retail investors. Two main forms stand out:

-

Payment for Order Flow (PFOF): A major revenue source for some neobrokers, PFOF involves compensation for routing retail orders to specific market makers (often linked to internalisation). This can incentivise brokers to prioritise revenue over price quality, undermining their ‘best execution’ obligation by increasing implicit costs. The EU is set to ban PFOF entirely by 2026 to mitigate this.

-

Rebates from ETF providers: Some platforms receive payments from asset managers for promoting/listing certain ETFs. This creates a subtler conflict, as platforms may highlight products offering higher rebates for them rather than those best suited (or cheaper) for the investor. Over time, this can steer investors towards ETFs with higher fees (TERs), quietly reducing long-term returns; often without clear or prominent disclosure.

While both practices have helped reduce explicit trading costs, they also raise concerns about transparency and the misalignment between platform incentives and investor outcomes.

Securities Lending Risks

Another revenue-generating practice used by neobrokers (and some traditional brokers) is securities lending; where client-held securities are lent to third parties, often short sellers, while the broker retains the collateral and income generated. While this can help support low-cost business models, it introduces genuine risks such as counterparty exposure, collateral shortfalls, and loss of shareholder rights (e.g. voting restrictions). Transparency is limited, revenue sharing is rare, and lending is often enabled by default without clear opt-in. Clients may also face restrictions on trading or transferring loaned securities. This trade-off between broker revenue and client risk is not always clearly disclosed, therefore individual investors should assess their brokers practices in securities lending.

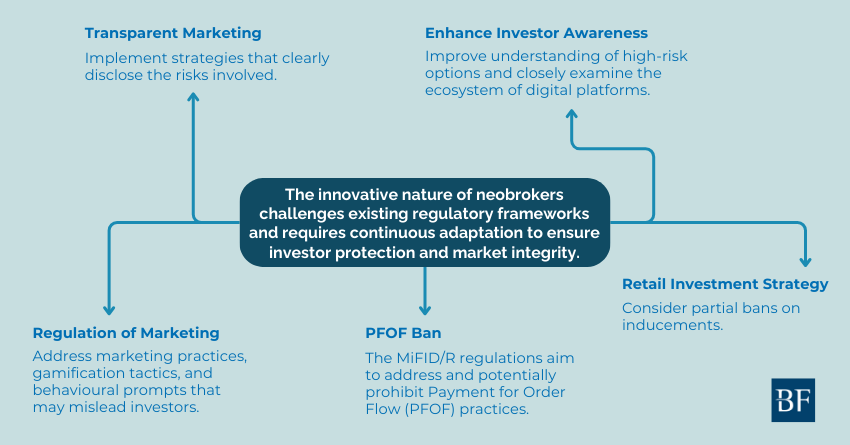

Challenging the Regulatory Framework

The innovative nature of neobrokers (and digital brokerage) pushes the boundaries of existing regulatory frameworks, necessitating continuous adaptation to safeguard investors and market integrity. This demands fostering a consumer-centric ecosystem built on readily accessible, unbiased information to ensure services genuinely align with clients’ best interests.

Thus, it is crucial that regulatory frameworks ensure the robust integration of technology-driven financial services.

Key considerations include:

- Marketing & Behavioural Practices: Regulations should curb misleading strategies (including ‘finfluencers’), gamification, and prompts encouraging excessive trading in digital engagement and social trading features. Crucially, clear ‘duty of care’ rules must be explicitly established, ensuring platforms act in the best interest of clients by prioritising ‘value for money’ (considering not just low cost but also the appropriateness of services), while safeguarding clients from harm caused by excessive trading.

- Transparent Execution & Information: Regulations should mandate clear disclosure of investment risks, trade details (spreads, fees, venue), conflicts of interest, counterparty risks, and comprehensive details on securities lending (borrower, collateral, risks), extending beyond opt-in to include revenue sharing schemes and overall transparency.

- Enhanced Investor Awareness: Enhanced Investor Awareness: Improve understanding of high-risk investments, potentially restricting access where necessary, via stronger platform oversight and client assessment, transparency, clear risk warnings, and responsible educational design for retail investors.

- Retail Investment Strategy: protect execution-only investors and mitigate conflicts undermining their best interest, policymakers should ban inducements in these services or adopt equivalently robust measures, like stringent transparency and enforced positive investor outcomes. Similarly, restricting inducements in traditional advisory models is crucial to address inherent biases and ensure a level playing field across all investment channels and secure trust in financial services.

- PFOF Ban: EU rules (MiFID II/MiFIR) will prohibit Payment for Order Flow (PFOF) to cut conflicts and further ensure best execution for retail clients.

* Note on Integrated Platforms: Fintechs – especially neobrokers and neobanks – are increasingly bundling investing, banking, and payments into seamless platforms (often via 'embedded finance' under white-labelling). While convenient, this ‘one-stop-shop’ model can blur regulatory boundaries, and obscures rules and liability safeguards – exacerbating intermediation risks. As services converge, investors need clarity.

Five-Point Checklist for Self-Directed Investors

- Understanding What You’re Signing Up For

Integrated platforms can combine investment services, savings accounts, and payment services, making it harder for new clients to distinguish or understand the mechanics between them. This streamlining of investment, while convenient, adds new awareness complexity often due to intermediated services, which further complicate understanding of the risks and protections involved. This requires investors to actively seek clarity on how their funds are treated within each integrated component. - Clarity on Protections and Regulation

Choosing a regulated firm, preferably EU-based for clear oversight, and understanding the scope of investor and deposit guarantee schemes. Critically, verify if securities are held with a depository or further intermediated, and ensure proper segregation of accounts. This is paramount for asset protection under relevant guarantee schemes. - New, Featured or Risky Products

Online platforms introduce evolving features needing careful evaluation. Money market funds differ from classic savings by exposing investors to market fluctuations and lacking deposit insurance. Fractional shares vary significantly in structure and trading discretion, impacting risk and ownership. Complex investments and derivatives are high-risk, designed for advanced investors with thorough understanding. Automated tools, including recurring savings and advanced algorithms, like rebalancing, require scrutiny regarding transparency and alignment with individual strategies, as they can introduce risks and costs. Understanding these distinctions is crucial for informed investment decisions. - Hidden Costs and Fees

Although many platforms advertise zero-commission trading (an explicit fee), hidden costs (implicit fees) can still significantly affect your investment returns. These include the spread, payment for order flow (PFOF) (where platforms earn revenue by directing your trades), and internal execution practices that might not always offer the best price. It’s crucial to understand the full cost structure, especially with freemium or subscription models, as these often offset the lack of direct commissions with other less obvious expenses or potential opportunity costs. Remember, there’s no such thing as a free lunch in investing. Investors should diligently assess whether the perceived benefits of a platform truly justify these explicit and implicit costs. - Frictionless Trading: A Positive Nudge?

While the ease of trading via linked accounts, debit cards, and automated investing, alongside engaging prompts and interactive features like real-time market updates and gamified elements, can lower barriers to entry and facilitate regular investing, it also presents risks. This ‘frictionless’ environment can nudge investors, particularly newer ones, towards impulsive trading decisions fuelled by readily available information and platform design. Such behaviour can increase risk exposure and potentially derail long-term investment returns. Therefore, while convenient, investors must be mindful of their trading behaviour, prioritise strategic decision-making over immediate impulses, and consider implementing strategies like setting trading limits to mitigate these risks.

The Bottom Line

Neobrokers are reshaping retail investing—offering broader access, lower costs, and greater autonomy. But with this innovation come new risks: from hidden fees to behavioural nudges and increasingly complex products and services.

Still, for informed investors, these platforms can be powerful tools for long-term wealth building—with strong potential to outperform traditional high-fee or overly complex banking and investment products.

*This article is created as part of BETTER FINANCE’s social media educational campaign to make finance more accessible to Europeans. Check the original post on our LinkedIn page.

To download the original post as PDF, click here.