Actively participates in EU financial policy advisory groups and processes.

Engages in campaigns that provide relevant information and enhance protection for end-users.

Promotes market integrity and transparency for individual investors and non-industry stakeholders.

Advocates for improved governance of financial supervision to benefit all European citizens.

History

EuroInvestors

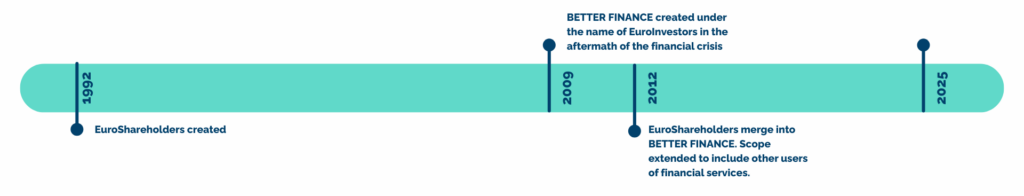

BETTER FINANCE was created in 2009 following the financial crisis to federate individual investor organisations across Europe, including but not limited to shareholder associations. It also advocates for investors in fixed income securities such as bonds, in investment funds, in life insurance and pension funds, as well as those investing in bank savings products.

Today, individual investors are mainly offered “packaged” products rather than securities (shares and bonds): 78% of EU households’ financial assets are held in such packaged investment products (life insurance, pension funds, bank accounts, investment funds). Since the 2008 financial crisis, new EU regulations have improved the protection of individual investors, but BETTER FINANCE believes much remains to be done to ensure consistent levels of protection, business conduct rules, and disclosure of key information.

EuroFinUse – BETTER FINANCE

At the initiative of Euroshareholders and FAIDER, the French Association for Independent Pension Savers, the European Federation of Investors was created in 2009 under the name EuroInvestors.

In 2012, the organisation changed its name from EuroInvestors to EuroFinUse – the European Federation of Financial Services Users – to better reflect its expanded scope and membership.

Since then, BETTER FINANCE has also extended its focus beyond individual share ownership and investments to other financial services users, such as savers – particularly bank savers (who hold 35% of EU households’ financial assets in bank accounts) – as well as life insurance policyholders, pension fund participants, mortgage borrowers, foreign exchange users, credit card holders, and more.

BETTER FINANCE brings its expertise in investment and financial matters to these retail financial issues and cooperates with other consumer and civil society organisations in this field.